As the Autumn Statement approaches, markets remain focused on the fiscal stance the Chancellor is likely to take. With inflation still elevated, monetary policy tight, the balance between prudence and ambition will be critical. Investors are not just watching the totals, they're watching the choices that shape them.

Deficit and Gilt Issuance in the Spotlight

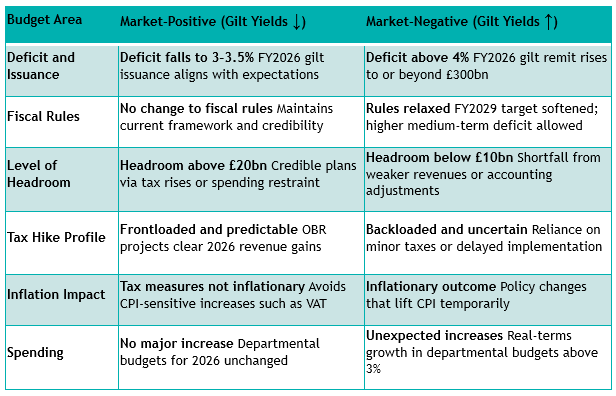

Foremost among market concerns is the trajectory of the deficit and its impact on gilt issuance. A path that sees the FY2026 deficit falling to 3–3.5% of GDP would be broadly supportive for gilt markets, suggesting a manageable supply of new government debt and reaffirming the Treasury’s commitment to fiscal discipline. Conversely, a deficit above 4% or issuance creeping over the £300bn mark would stoke concerns around sustainability, pressuring gilt yields upwards.

Add to this, Labour’s spending tendencies and the risk here is likely gilt yields will rise.

Fiscal Rules as a Credibility Anchor

Fiscal rules form the backbone of investor confidence. Markets will be reassured by the maintenance of the current framework, particularly the commitment to having debt falling in the final year of the forecast. Any relaxation, such as allowing a small deficit in FY2029 or changing rule definitions, would be interpreted as a weakening of fiscal resolve, potentially inviting closer scrutiny from ratings agencies and raising long-term borrowing costs.

The idea of Rachel Reeves losing her job was a perfect example of the market reinforcing the idea of credibility by gilt yields falling in support of her retaining her job. Also perhaps perpetuated by Andy Burnham’s short-lived manoeuvring highlighting his lack of fiscal credibility.

Headroom: Cushion or Mirage?

The amount of headroom built into fiscal forecasts will be another key signal. A buffer above £20bn would indicate prudent planning and provide insurance against future shocks. However, if that figure falls below £10bn, or appears reliant on creative accounting or over-optimistic assumptions, markets may question the realism of the government’s fiscal strategy.

Last year the Chancellor gave herself only £10bn of headroom, which continues to be eroded and is one of the reasons for further measures. It would be more prudent to provide a larger headroom, however this again seems unlikely.

Spending Restraint Supports Confidence

On the spending side, restraint remains the market’s preference. Holding departmental budgets flat in real terms through 2026 would support the consolidation narrative. Any deviation, particularly real-terms increases beyond 3%, could undermine deficit reduction plans and suggest fiscal loosening in disguise.

The Government is almost desperate to avoid being labelled with an austerity tag, so real terms increase in spending is probable. The most likely outcome is a mixed approach, there will likely be areas with increased spending and some aspects of spending that could be restrained. Given the Governments track record with curtailing spending, particularly with the winter fuel allowance reversal, aggregate spending is likely to increase. This will lead to upward pressure on yields.

Tax Timing and Structure Matter

Tax policy is another area where timing and structure are key. Markets would prefer material, frontloaded revenue increases in 2026, as projected by the OBR. This supports near-term targets and limits the need for further borrowing. Delayed implementation or reliance on minor, politically expedient tax bases would raise concerns over the sustainability of the overall plan.

The obvious tax to point to here is the proposed income tax change which the Chancellor had proposed to the market. Despite being in breach of one of Labour’s manifesto pledges, it was happily received by the market and for two weeks gilt yields fell until last Friday. The subsequent U-turn on these changes brings back a lot more uncertainty about what taxes will now be raised, and an uncertainty premium has returned to gilt yields. After the budget, the uncertainty premium will likely ebb away from yields.

Avoiding Inflationary Pressures

Lastly, the inflationary effects of fiscal policy remain a live issue. Tax measures that push up CPI, such as changes to VAT, may complicate the Bank of England’s policy response and risk reigniting inflation volatility. Measures that steer clear of fuelling short-term inflation would help anchor expectations and stabilise gilt markets. Changes to green levies may contribute some downward pressure on energy bills.

The minimum wage increases, employers NICs and perhaps even public sector pay rises after strikes have contributed to elevated inflation and has fed into fewer BOE base rate cuts.

Credibility Over Creativity

Markets are looking for signs of consistency, credibility, and control. The Autumn Statement presents an opportunity to reinforce the UK’s fiscal anchor. Any deviation, whether through loose rules, rising deficits, or uncertain tax plans, risks increasing the government’s borrowing costs at a time when fiscal space remains narrow.

On balance, the risks are weighted to the upside. With policy uncertainty currently baked into existing rates, and the higher likelihood of a smorgasbord of smaller tax hikes, fiscal drag, and limited spending cuts, the government may emerge with an approved fiscal position, but with high levels of national debt, persistent deficit and ongoing debt issuances contributing to higher gilt yields.

21/11/2025

Related Insights

What to Expect in the Autumn Budget?