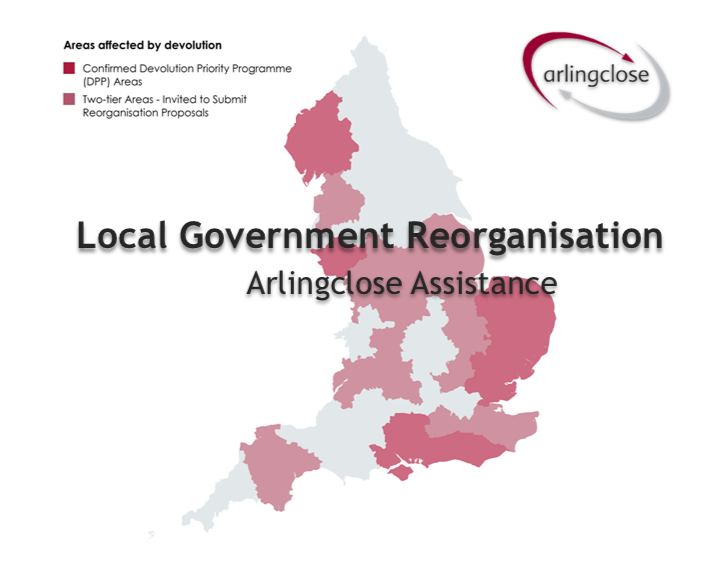

Local Government Reorganisation Assistance

Local government reorganisation brings major challenges for finance teams. Mergers and splits of authorities require Treasury Management functions to remain robust, compliant and operationally ready from day one.

Arlingclose has a proven track record of supporting authorities through structural change. We ensure continuity, financial integrity and compliance, while guiding councils through the complexities of debt, investments, balance sheets and governance. Our experience from previous reorganisations means we understand what works, where risks lie and how to deliver value throughout the transition process.

Why Choose Arlingclose?

Specialist Expertise: Decades of Treasury Management advisory experience with local authorities across the UK.

Proven Track Record: Hands-on support in previous reorganisations, delivering practical, workable solutions.

Independent Advice: We act solely in the interests of our clients, ensuring compliance, resilience and value.

End-to-End Support: From governance and planning through to post-implementation review.

Get in Touch

If your authority is preparing for reorganisation, we can help you safeguard financial integrity, manage risk and ensure Treasury Management is ready for vesting day and beyond.

Contact us at treasury@arlingclose.com.

How We Help

We provide end-to-end support across all key areas of Treasury Management during reorganisation:

Project Governance and Planning

We establish Treasury Working Groups, governance structures and communication plans, ensuring smooth coordination across all affected authorities.

Balance Sheet Reconciliation

We guide authorities in consolidating or disaggregating opening balance sheets and Liability Benchmarks, ensuring accuracy, transparency and regulatory compliance.

Debt Portfolio Allocation

We review all debt instruments and advise on fair, legal and transparent allocation methods. Our lender relationships, including with the PWLB, help streamline approvals and novations.

Investment Balances and Cash Splitting

We ensure investments are allocated fairly, cashflow forecasts are aligned, and risk appetite and liquidity needs are appropriately managed.

Asset Transfers and Capital Programme Alignment

We support capital programme reviews, ensuring assets and borrowing requirements align with the new authority’s strategic objectives.

MRP Policy Harmonisation

We model and recommend consistent, CIPFA-compliant policies that balance affordability and financial resilience.

Banking and Treasury Operations

We manage the transition of banking platforms, mandates and operational controls to guarantee continuity from vesting day.

Treasury Management Strategy and Governance

We develop new Treasury Management Strategies, prudential indicators and governance arrangements that reflect the new organisation’s ambitions and compliance obligations.

Risk Management

We assess, map and mitigate treasury risks, ensuring authorities have contingency liquidity and robust stress testing in place.

Training and Resourcing

We identify skills gaps, provide tailored training for finance teams and elected members, and ensure new structures are resourced effectively.

Contingency Planning

We develop safeguards for legal, operational and financial risks, ensuring strong audit trails and protection against system or data issues.

Post-Implementation Review

We conduct independent reviews post-vesting day, resolving imbalances, finalising treatments and embedding lessons learned.