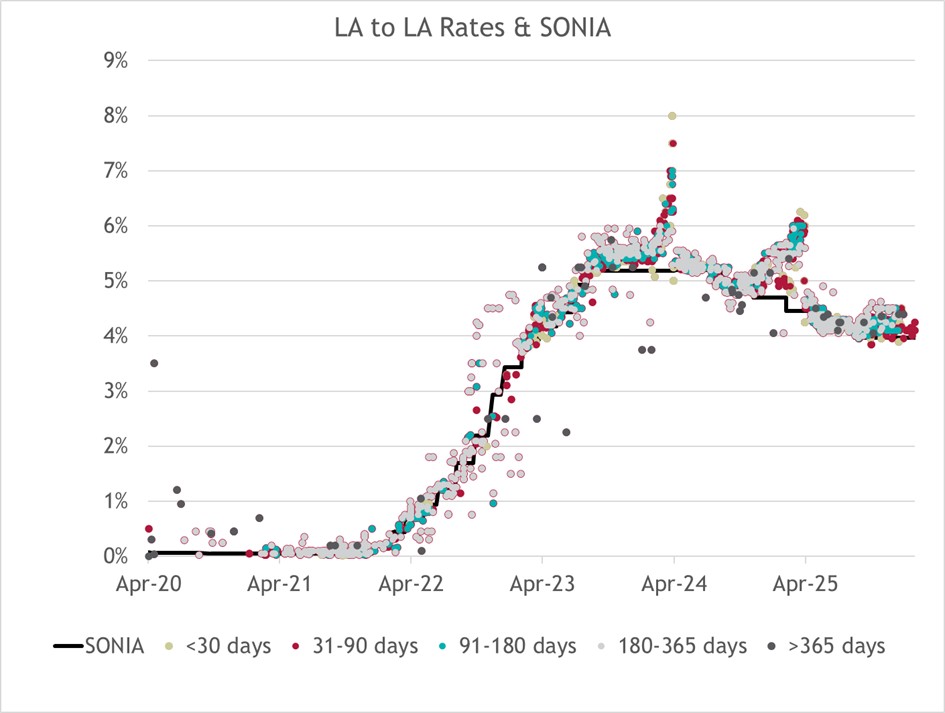

As we edge closer to year-end, conditions in the inter local authority (LA-to-LA) lending market have become noticeably tighter, with a spike in rates indicating reduced availability of surplus cash. While the market continues to tick along, higher borrowing costs reflect the seasonal nature of local authority cash flows, with council tax receipts tapering off towards year-end, capital budgets being utilised, and grant income generally front loaded earlier in the year. Cash has been squeezed further by budgetary pressures at some authorities around social care and special educational needs.

Short-term pricing illustrates this shift. Three-month money spanning the year-end is currently being quoted at 5.0% on iDealTrade (Arlingclose’s dealing platform), equivalent to SONIA plus 127 basis points. Such pricing is not unprecedented in periods of tighter liquidity, but it does represent a step up from levels seen earlier in the year.

Further out, one-year LA borrowing has also crept up, with rates now being quoted up to 4.4%, broadly in line with the one-year PWLB certainty rate (4.38% at the time of writing) and equivalent to 1-year SONIA plus 90 basis points. At these levels, the traditional cost advantage of the LA-to-LA market over PWLB has narrowed considerably. That said, shorter-dated borrowing at a higher margin may still be acceptable where it provides certainty over year-end, provided elevated costs are not locked in for longer than necessary.

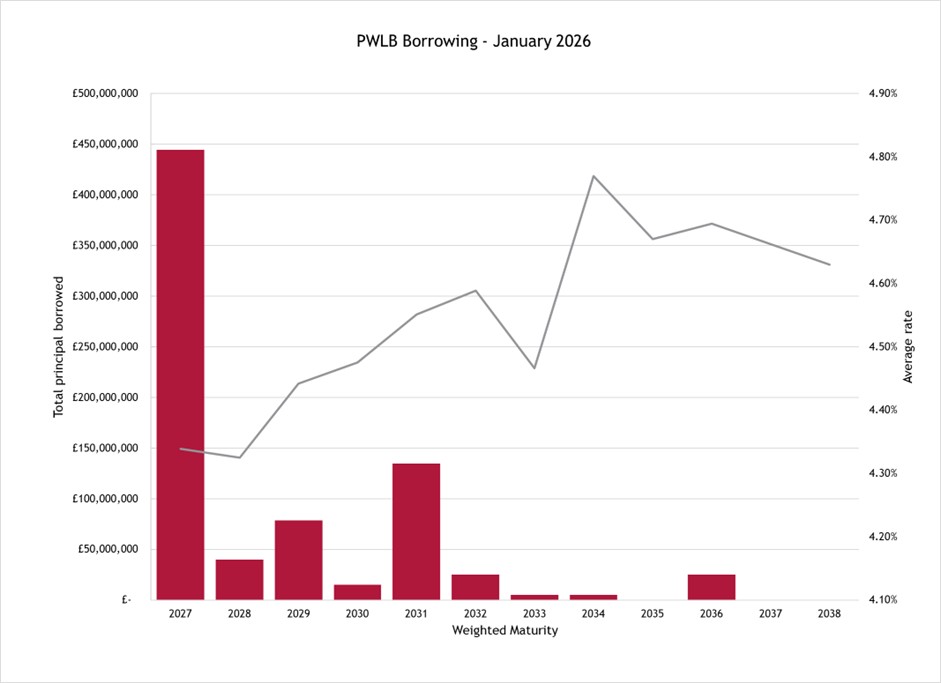

Borrowing data suggests that authorities have already begun to adjust. In January, £1.5bn was borrowed from the PWLB, with an average maturity of 2.4 years, shown in the chart below. This relatively short average life could indicate that the PWLB is being used tactically to supplement near-term funding requirements as an alternative to LA borrowing. It also highlights the continued role of PWLB as a stable and predictable source of liquidity when market conditions are less accommodating.

More recent trends, and a contributor to the heightened spread, include consistently lower cash balances due to budgetary pressures (as evidenced by the latest MHCLG data showing a fall in balances of nearly £1bn over the year to September 2025) and a reluctance to lend to authorities considered financial weaker for reputational reasons.

From a treasury management perspective, these developments reinforce the importance of maintaining flexibility on both the borrowing and investment sides. Avoiding a concentration of maturities in the final quarter of the financial year is likely to remain prudent, given the volume of one-year borrowing undertaken this time last year that will require refinancing in Q4. Access to multiple funding routes, including PWLB, continues to provide a valuable safeguard, while expectations around LA to LA borrowing costs may need to be adjusted in the near term.

While some easing in conditions may follow year-end, careful liquidity planning and a diversified approach to funding remain central to effective treasury management.

09/02/2026

Related Insights

Why Use iDealTrade? 10 Key Benefits of the Platform