Treasury risk within housing associations is often described as well understood, well managed and well reported. However, familiar risks can receive disproportionate attention, while other risks can be assessed less frequently. Understanding each risk and how it manifests over time is essential if long-term financial plans are to remain credible and resilient.

Interest Rate Risk

Interest rate risk is the risk that changes when market interest rates increase the cost of borrowing or reduce forecast affordability. For housing associations, this risk arises through exposure to variable-rate debt, refinancing of maturing facilities and assumptions about future funding costs embedded within business plans. While fixed-rate debt can reduce short-term sensitivity, interest rate risk remains relevant over the long term as debt matures and new funding is required. The risk is therefore less about immediate volatility and more about the cost and availability of funding across future credit cycles.

With a high proportion of fixed-rate debt across the sector, short-term movements in base rates often have a limited impact on cash flow. While rate risk is visible and easy to explain, it is no longer the defining treasury threat for most organisations.

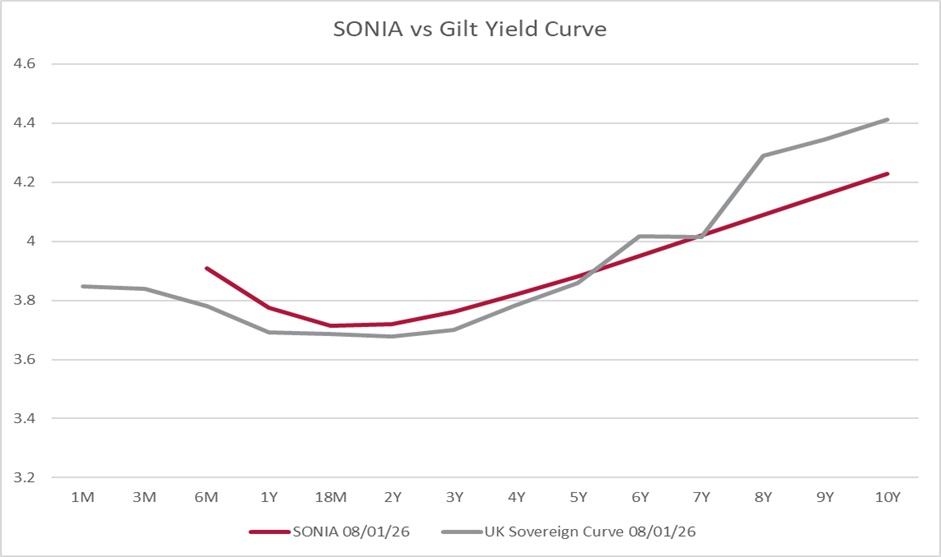

The current shape and steepness of the yield curve presents both opportunity and risk. The current yield curves, whether linked to SONIA or gilt yields for government backed funding, has certainly shortened funding, consequently increasing the interest rate and refinancing risk associated when that debt matures. The current trough in rates is around the 2-year duration, indicating the second half of 2027 is likely to be an uncertain period to prepare for.

Liquidity and Cashflow Sequencing Risk

Liquidity risk is the risk that an organisation does not have sufficient cash available when it is needed, even if it appears solvent on a longer-term basis. In housing associations, this risk is often driven by the timing of cash inflows and outflows rather than overall funding capacity. Development expenditure, grant receipts, asset sales and debt drawdowns do not always align, creating short-term pressure points. Cashflow sequencing risk reflects the possibility that these timing mismatches strain liquidity at critical moments.

Liquidity risk is often assessed using static measures such as months of cash cover, which can provide false reassurance. The real risk lies in cash flow sequencing. Development expenditure, grant receipts, asset sales and debt drawdowns rarely align neatly, and short-term pressure can arise even within an apparently well-funded plan.

Covenant Headroom Risk

Covenant risk is the risk that a housing association breaches, or comes uncomfortably close to breaching, the financial covenants attached to its borrowing. Covenant headroom risk refers to the gradual erosion of buffer above covenant thresholds. This can be driven by changes in asset valuations, shifts in development profiles, cost inflation or accounting treatment. Unlike a sudden breach, erosion of headroom reduces flexibility and increases sensitivity to shocks, often well before any formal non-compliance occurs.

Covenant risk is typically presented as a binary outcome. Covenants are either compliant or they are not. This masks the gradual erosion of headroom and the interaction between different covenant tests. Changes in asset valuations, development phasing or accounting treatment can materially reduce flexibility long before any formal breach occurs.

Security and Asset Charging Risk

Security risk is the risk that a housing association has insufficient uncharged assets available to support future borrowing or refinancing. As debt increases and assets are charged, security capacity is progressively consumed. This risk becomes acute where asset values fall, development relies on secured funding or lender documentation restricts substitution. A lack of available security can constrain lender choice, increase funding costs and limit strategic options, even where covenant and liquidity positions appear stable.

Arlingclose arranges unsecured funding for housing associations to ease pressure on existing secured funding arrangements and provide access to funding, whether through fixed-term loans or RCF structures.

Refinancing and Market Access Risk

Refinancing risk is the risk that a housing association is unable to replace maturing debt on acceptable terms, or at all. This risk reflects both market conditions and the organisation’s own financial profile at the point of refinancing. Even where maturities sit many years ahead, the time required to restructure debt, rebalance security or negotiate new facilities means this risk emerges well in advance. Market access risk recognises that funding availability cannot be assumed in all economic or sector conditions.

Refinancing risk is frequently discounted where debt maturities sit beyond the medium term. This overlooks the lead time required to restructure debt, diversify funding sources or renegotiate documentation. Market access is not guaranteed, particularly during periods of sector or economic stress.

Embedding Treasury Risk Within Long-Term Financial Planning

These risks are best understood through long-term financial planning supported by structured scenario testing. Each risk should be tested in isolation to assess sensitivity, and in combination to reflect how treasury pressures typically arise in practice. Interest rate movements, liquidity timing, covenant capacity, security availability and refinancing conditions interact, often reinforcing one another at key points in the business plan.

Scenario testing allows Boards to see where resilience relies on favourable assumptions and where early intervention would be required. A credible long-term plan does not eliminate risk but demonstrates that the organisation can withstand plausible combinations of treasury stress while maintaining strategic flexibility.

Arlingclose has experience with budget forecasts and the assumptions required to maximise accuracy and usefulness. This has allowed us to develop unique opportunities through unsecured lending or syndicated RCFs to reduce covenant risk, refinancing risk and also cash flow sequencing. Please get in touch with Arlingclose today at info@arlingclose.com or sjones@arlingclose.com to discuss how we can support your organisation in managing and mitigating these treasury risks.

12/01/2026

Related Insights

How Will the Budget Affect Housing Associations?