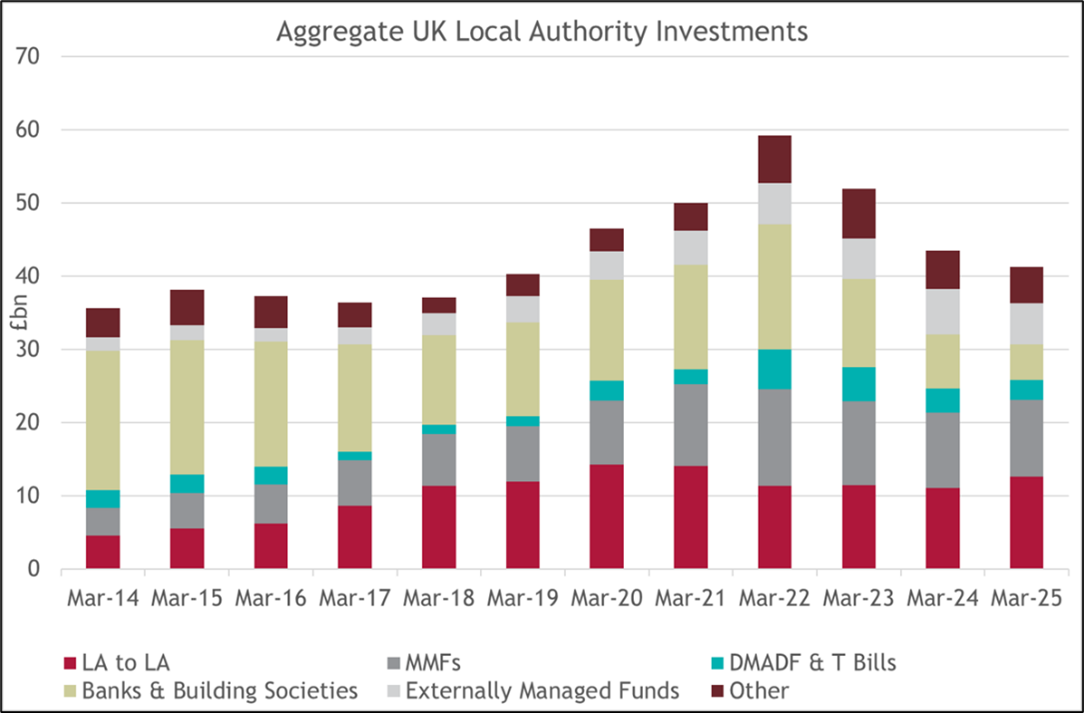

UK local authority investment data (released by The Ministry of Housing, Communities and Local Government), highlights an increase in local authority-to-local authority (LA-to-LA) lending, both in absolute and real terms. The chart below shows how the UK Local Authority investment mix has changed in the last twelve years. LA-to-LA lending has become a more significant component of the mix, whilst other investment options, such as banks and building societies, have experienced a decrease.

Absolute Growth in LA-to-LA Lending

Since March 2014, LA-to-LA lending has increased substantially. The 2014 total stood below £5bn, but this has more than doubled in March 2025, with the total reaching over £12bn. While the peak was reached in 2020, at £14.2bn, investment levels have since stabilised slightly below that high, yet remain well above pre-2018 figures.

Growing Share of the Investment Mix

Moreover, LA-to-LA lending has also expanded in relative terms, contributing to a larger proportion of the UK local authority investment mix. In 2014, the investments made up a modest share of local authority portfolios – representing around 12.6% of total investments. However, in 2025 this has increased considerably, representing over 30% of the total £41.3bn invested.

This is significant in comparison to other categories, many of which have stayed broadly stable or experienced a decline as a share of the overall portfolios. For example, investments in banks and building societies have fallen from 19.0bn in 2014, to £4.8bn in March 2025 – making up a much smaller proportion of the investment mix then it once did. In contrast, LA-to-LA lending has moved in the opposite direction, benefiting from both the contraction in the other options and the increasing appeal of LA-to-LA deals.

Investments in DMADF & T Bills has remained relatively stable, with a slight increase from £2.4bn in 2014 to £2.7bn in 2025.

Drivers of the Shift

Several key factors are likely to have contributed to this growth, including the flexibility and simplicity of local authority deals. LA-to-LA lending rates have, at times, been more favourable than investments in MMFs or banks, particularly during episodes of market volatility. Alongside this, the decline in banking deposits has also contributed to the shift of the LA investment mix, due to the lower rates being offered by banks amid changing regulation.

The rise in LA-to-LA lending is also supported by the perceived security of counterparty risk. Unlike other investment types that expose authorities to market fluctuations or institutional credit risk, lending to another local authority is generally considered secure due to the statutory backing of these entities. This has been particularly attractive in periods when the wider banking sector has faced stress or uncertainty, and where concerns over bail-in risk may reduce the appeal of making deposits with banks.

Another important feature has been the role of LA-to-LA lending in liquidity management, with loans available for less than a year or even overnight, in contrast with the PWLB loans facility.

The administrative simplicity of these arrangements, particularly when using the iDealTrade platform, has also added to their appeal.

Outlook

The role of LA-to-LA lending has become a more significant part of the investment mix, experiencing both relative and absolute increases, whilst overall investment balances have declined. This shows the mutual support between local authorities, as they provide each other with another source of funding.

01/10/2025

Related Insights

Local Authority Investment Trends in 2025

What do the MHCLG Live Tables tell us about LA Investment Balances?