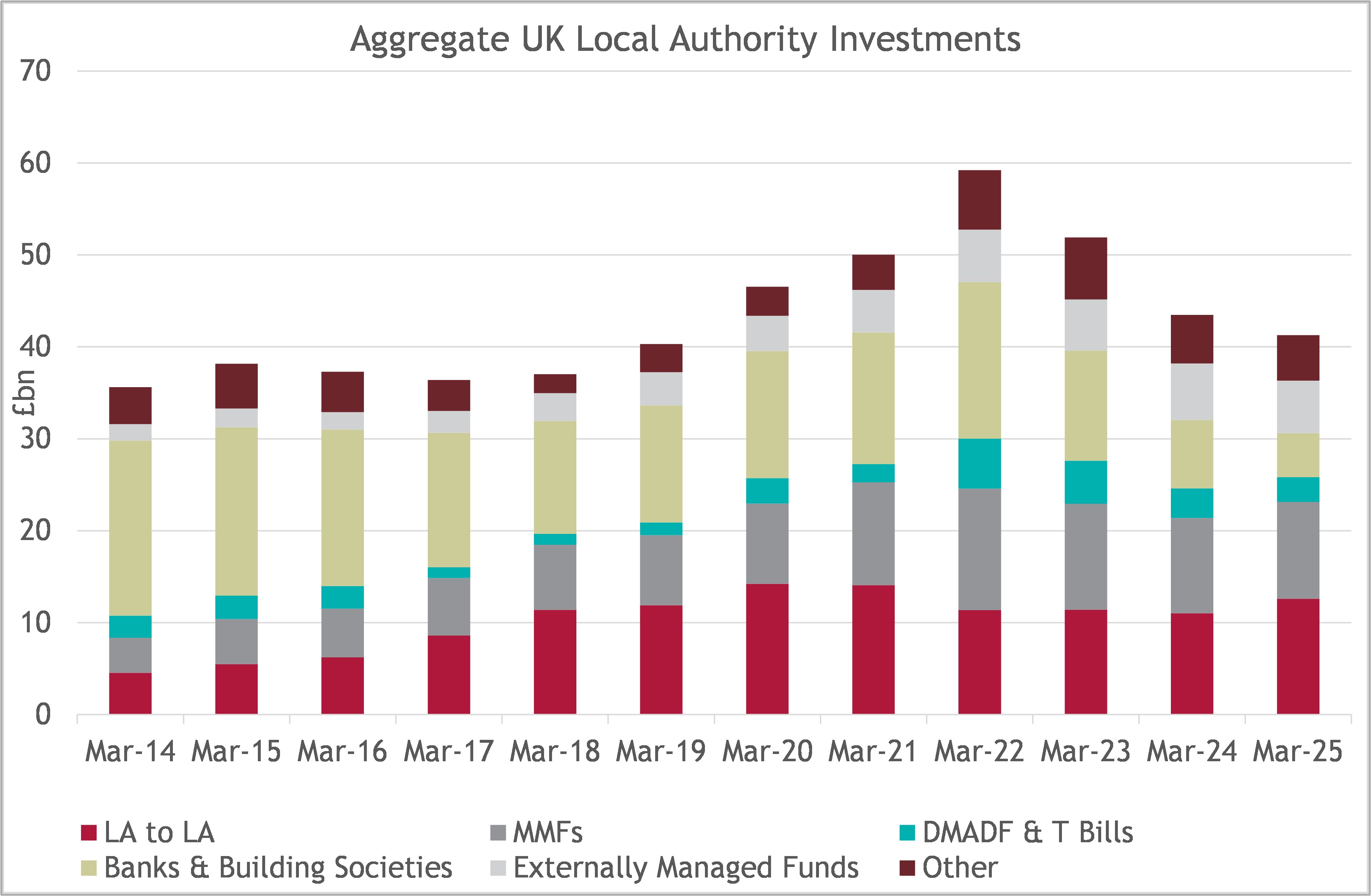

The Ministry of Housing, Communities and Local Government (MHCLG) has released the latest iteration of the Borrowing and Investment Live Tables for UK local authorities, with data to March 2025 allowing for a (financial) year-on-year comparison of overall LA investments levels.

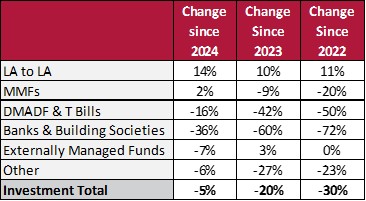

This reveals a further contraction in LA investment balances, albeit at a slowing pace this year, with the total having declined by 5% since March 2024 to stand at £41.3bn. Investments have now shrunk by 30% compared to the peak of almost £60bn seen in 2022 but remain £1bn higher than pre-Covid levels. This reflects the unwinding of pandemic-era impacts, the trend of utilising cash balances and reductions in reserves as financial pressures continue to bite.

Below we summarise the key developments across each investment category, which we have grouped for simplicity.

LA-to-LA

Local authority-to-local authority lending has continued to grow, up by 14% since last year. This underscores the enduring appeal of LA-to-LA deals as a competitive and flexible source of short-term investment despite the financial challenges facing the sector and some high-profile reputational issues in recent times. Authorities continue to offer and take advantage of favourable rates and LA-to-LA deals remain a significant and stable element of local authority portfolios, underpinned by their simplicity and attractive risk-adjusted returns – plus the fact that many LAs have an ongoing need to borrow.

Money Market Funds (MMFs)

The only other category to see a rise this year, MMFs remain a popular short-term investment tool for LA treasurers, with over £10bn of LA cash parked in them in 2025, having posted a modest 2% increase since last year. Their liquidity and competitive returns have likely maintained the appeal but nevertheless, a broader downward trend reflects cash being diverted to fund capital programmes or to delay the need for new borrowing in a relatively high-rate environment.

DMADF and Treasury Bills

Short-term exposure to the UK government via the Debt Management Account Deposit Facility and T-bills has seen a 16% fall since 2024, compounding to a 42% drop since 2023 and a 50% fall relative to 2022. The initial surge in DMADF usage in 2022, driven by attractive rates and central government demand, has since unwound. With many LAs needing to maintain highly liquid portfolios, options such as MMFs have likely been more attractive, with less administration and competitive returns.

Banks and Building Societies

The most dramatic shift has occurred here, with balances falling 36% over the past year and now 72% below their 2022 level. This reduction continues to reflect strategic decisions to limit credit exposure and seek better risk-return profiles elsewhere. Many banking institutions often fail to keep pace with market rates and as liquidity pressures mount and investment balances shrink, unsecured placements with banks and builders have been among the first to be drawn down.

Externally Managed Funds

Balances in externally managed funds have declined by 7% since 2024, though they have been relatively stable over recent years. This likely reflects a combination of some capital withdrawals as priorities shift and fluctuations in Net Asset Values, as changes here are also driven by financial market valuation movements.

Other Investments

This residual category, which includes gilts and corporate and covered bonds, has seen a 6% annual decline. This and the falls seen over previous years broadly align with the overall contraction in investment activity, as local authorities redeploy resources to support capital spending or reduce borrowing requirements.

Looking Ahead

The pace of decline in investment balances has slowed compared to 2023 and 2024 but spending pressures remain and further shrinking of investment levels wouldn’t be surprising. With many investment horizons shortening, overall a continuing focus on credit and liquidity risk management, while optimising returns, seems likely as we navigate an increasingly uncertain world.

For LAs with surplus cash, there remain opportunities to lend to their peers for flexible fixed terms at attractive rates, as we see via our lending platform iDealTrade. This also provides local authority Financial Strength Ratings for each deal, assisting authorities with counterparty due diligence and assessment of risk adjusted returns.

It’s clear that MMFs continue to be well supported by LAs. But as liquidity becomes even more important for many authorities and the drive for efficiencies persists, local authorities will look to optimise their MMF selection. MMF providers who offer a strong proposition on value, service, strategy and ESG issues, and engage with LAs effectively, will be the most attractive in a highly competitive market.

While the use of unsecured bank deposits & accounts seems unlikely to stage a big comeback, beyond offering better interest rates, institutions looking for funding may want to consider offering something which these stats don’t show: secured deposits. This collateral-backed and bail-in risk exempt option is growing in popularity with LAs and represents an opportunity for banks to remain a more significant part of the treasurer’s toolkit in the future.

Arlingclose helps many organisations to better understand their interactions with local authorities. Get in touch with us at info@arlingclose.com to discuss LA investments in more detail.

Related Insights

Are UK Financial Markets Safe?

Key Elements of an Effective Treasury Management Strategy

Have we really entered a post-pandemic era of higher policy rates?