The first US bank failure of 2026 arrived with few headlines.

While bank failures are not unusual, recent years have seen unusually low volumes: only two US banks failed in the whole of 2025, with combined assets of just US$113 million, following two failures in 2024. That stands in sharp contrast to earlier periods of systemic stress, when failures were counted in the dozens each year, such as during the global financial crisis when over 150 banks collapsed in 2010 alone.

Late on Friday night, Illinois regulators closed Metropolitan Capital Bank and Trust, transferring deposits through the Federal Deposit Insurance Corporation (FDIC) in what was officially described as a routine resolution.

With assets of only around US$261 million, this was not a major institution. The process was orderly, depositors were protected, and there were no immediate signs of wider instability across the US banking system.

Small bank failures rarely trigger contagion on their own, but they can act as early indicators of tightening financial conditions, particularly in a world where interest rates remain restrictive and funding pressures have not fully disappeared.

The margins of the system are often where problems emerge first.

For UK treasury investors, the relevance is clear. Financial shocks do not respect borders. Confidence moves globally, and risk is repriced rapidly across markets when liquidity becomes scarce.

That is precisely why creditworthiness remains the foundation of treasury management. Too often, credit risk is treated primarily as a compliance exercise, anchored around external ratings and minimum criteria.

Ratings remain valuable, but they are slow-moving and inherently backward-looking by design. They cannot provide early warning on their own, particularly in an environment where market sentiment can shift rapidly.

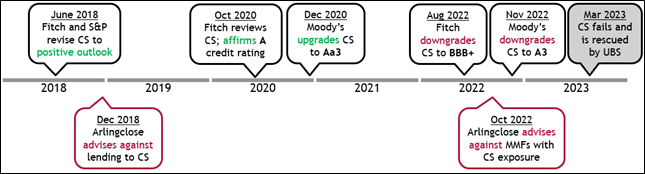

The collapse of Credit Suisse in 2023 remains the clearest modern example. Credit Suisse was investment grade for years, yet market confidence deteriorated well before formal downgrades arrived, and by the time agencies acted decisively, the market had already moved on.

At Arlingclose, we removed Credit Suisse from our advised lending list as early as 2018 and suspended a money market fund with exposure in October 2022. That was not because we had access to privileged information, but because robust credit advice requires more than ratings. It requires judgement, market awareness, and the willingness to act early when concerns begin to build.

Today’s resolution regimes have shifted away from bail-outs towards bail-ins, meaning wholesale depositors can no longer assume they sit outside the loss-absorbing perimeter. Balance sheet structure, depositor hierarchy, and jurisdictional resolution frameworks now matter as much as headline capital ratios.

Market indicators also play a critical role. Credit default swap spreads, bond yields, and equity price movements frequently reveal stress far sooner than any agency report, while macroeconomic context matters deeply for regional lenders operating in weaker or concentrated markets.

Qualitative factors cannot be ignored either. Governance concerns, regulatory scrutiny, reputational risk, and shifting political assumptions all shape credit outcomes in ways that traditional metrics often fail to capture.

This is why Arlingclose undertakes a comprehensive assessment across seven core credit factors, combining ratings data with proprietary balance sheet analysis, real-time market monitoring, sovereign assessment, and an experienced subjective overlay. These indicators are continuously monitored and interpreted collectively, allowing duration limits and counterparty access to be adjusted proactively as credit conditions evolve, rather than reactively once a problem becomes a headline.

The aim is straightforward: to provide clients with counterparty recommendations and duration limits designed for resilience, rather than for yield chasing.

Credit advice is not static, and it must evolve with conditions. Duration limits must shorten when risks rise, counterparties must be suspended when concerns become serious, and treasury teams must remain willing to take preventative action even when ratings have yet to move.

Metropolitan Capital Bank is not Lehman Brothers, but it is a timely reminder that fragility still exists.

For more information on Arlingclose’s creditworthiness service and wider treasury management advice, please contact the team.

03/02/2026

Related Insights

Why Are Secured Deposits Safer Than Bank Accounts?

How Do Credit Ratings and CDS Spreads Help Us Assess Creditworthiness?