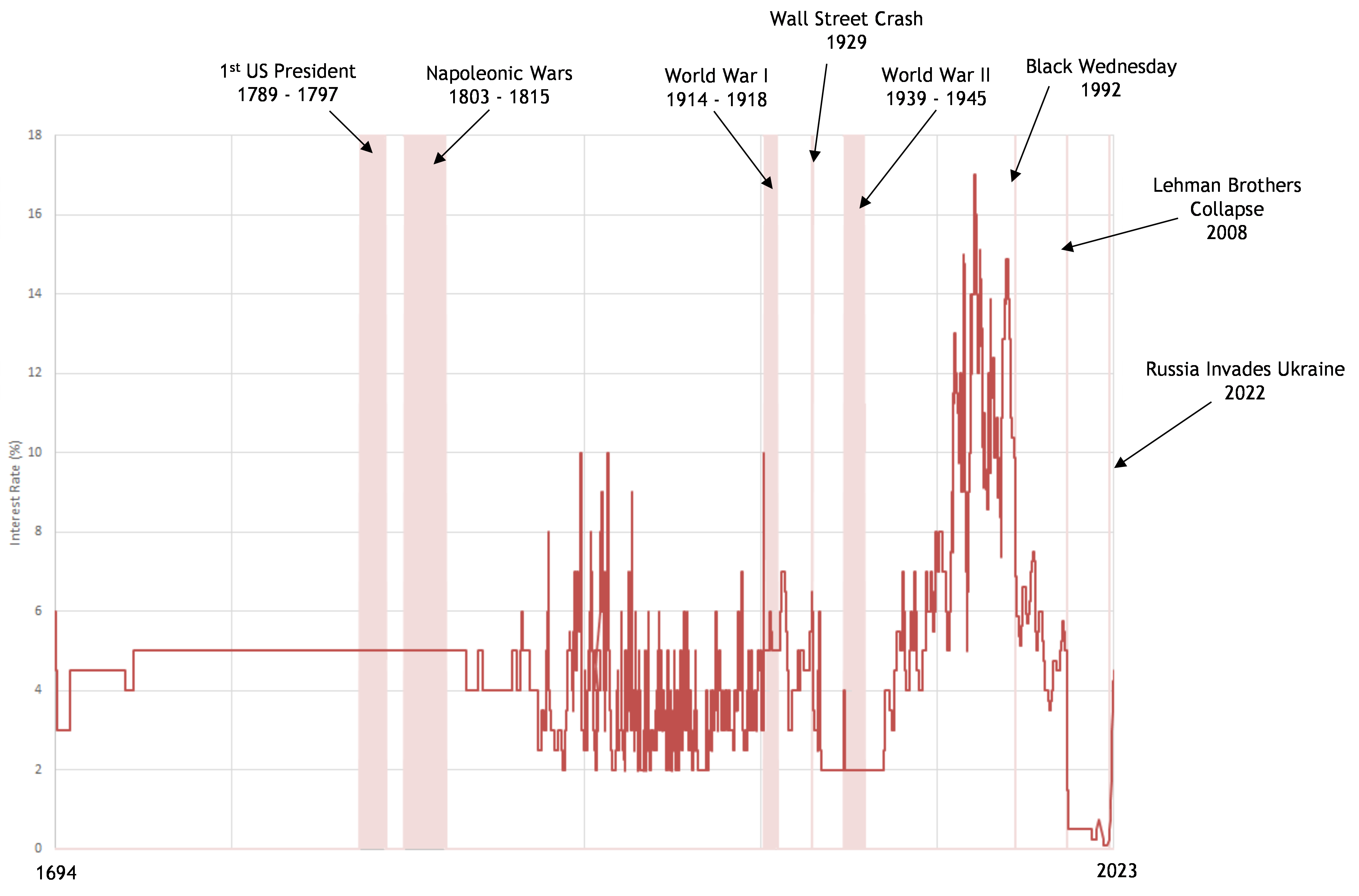

Hindsight’s a wonderful thing. In October 2020, whilst working from home, keeping 2 meters away from everyone and not going to the pub I wrote this article musing on whether an interest rate of 0.1% might stick around for the next 300 years. As it turns out, events have somewhat changed this paradigm since. Interest rates today are at 4.5% which as you can see from the below is pretty much back at their historically ‘normal’ level:

What has caused this very rapid about turn on interest rates? Can we expect a return of the sky-high-rates of the 1980s, or a more placid range of about 2% - 6% for the foreseeable future?

The recent history story of interest rates is that they were cut in order to stimulate the economy and stave off another great depression following the financial crisis or ‘credit crunch’ of 2008. Quantitative easing (a modern version of printing money) was also used for the same reason. There were worries at the time this might backfire horribly and lead to high inflation in the future*. This didn’t happen, with inflation remaining stubbornly and sometimes dangerously low – CPI reaching minus 0.1% in April 2015. Very serious discussions were had about whether the Bank of England was going to make interest rates below zero to try and sort it all out.

The situation pre-Covid was one where the Bank of England was just starting to tentatively ween us off these very low rates. Rates were raised to 0.5% in 2017 and 0.75% in 2018. The motivation behind this was not that inflation was a problem or that the economy was starting to overheat: it was that we just could not have rates this low for this long and we needed to raise them so that we could lower them again when the next financial crisis came along. Then came the pandemic when rates were quickly lowered back down, along with a whole host of other actions to put the economy on emergency life support. To fund the cost of furlough schemes, test and trace and lost tax revenues the government printed money through more quantitative easing.

On 24th February 2022, just as most of us were trying to put the pandemic behind us, Putin invaded Ukraine. This led to a sudden and unexpected increase in energy and food costs as global trade with Russia, Belarus and Ukraine in these commodities was severely curtailed. This combined with the fact that more people were trying to spend money now they were allowed out of their houses, but workers were less able to produce goods and services due to illness, retirement or having gone back home during the pandemic. More money chasing less goods, and a government that had been printing money for years led to a perfect inflation storm. UK CPI rose from 0.4% in February 2021 to 6.0% in February 2022 to a peak of 11.1% in October 2022. It is currently a bit lower at 10.1%, although this is still well above Bank of England’s 2% target.

The Bank of England is in charge of getting inflation back down but it’s tools to do this are quite limited. It can’t stop wars or persuade more over fifties back into employment**. What it can do is raise interest rates: this reduces the money supply because people have to spend more on paying back their debts and can’t borrow as much. The Bank of England, along with other central banks across the world, has done this enthusiastically: rates rose from their historical low of 0.1% towards the end of 2021 to 3.5% a year later to 4.5% now. Rate rises this fast have been seen historically but are not exactly common: you have to look back to the heady rate rises of the 1970’s or the post Second World War period for anything similar.

What are the expectations for future rates? The mainstay of opinion amongst economist is that interest rates are unlikely to rise much further as inflation is expected to come down, as it has begun to do more significantly in the USA and the Eurozone. Rate rises will take effect, the world is adjusting out of the pandemic and oil prices are almost back to where they were before Putin’s invasion. A return of the high rates seen in the 70s and 80s is felt unlikely: central banks are now much more independent of political medalling and there is no longer the widespread unionisation of the workforce that led to a ‘wage-price spiral’ during this period. Rates are likely to go down a bit, but expectations are for this to be more like 3% than 0.5%. We may well look back at the low rates of 2008 – 2021 as a blip of history.

One dissenting voice in this consensus is that of the International Monetary Fund which in April 2023 forecasted that the current rate rises were likely to be ‘temporary’ with interest rates then returning to pre-pandemic levels. This is because the world is experiencing a challenge it didn’t face in 1694, the 1800’s or after the Second World War of an aging population. Older people borrow and consume less and save more. When you are young you are more likely to do things like buy a new house and car, when you are older saving for your pensions is more likely to seem like the best use of your money. This leads to a lower demand for money which makes it cheaper so interest rates fall. Japan, ever the demographic canary in the coal mine, has an interest rate of minus 0.1% and the world’s second oldest population (after Monaco). Ultimately economics is not an exact science and we will have to wait and see what the new history of interest rates will bring.

* Quantitative easing was and has been accused of other bad things as well such as increasing inequality by artificially inflating asset prices.

** These things are the job of politicians whom the Bank of England is (now) independent of.

Related Insights