The Financial Services Compensation Scheme (FSCS) is a key part of the UK’s financial safety net. It protects consumers when authorised financial firms fail and are unable to return customer money. In those cases, the FSCS may step in and pay compensation, subject to certain limits and eligibility criteria.

At present, deposits held with UK banks, building societies and credit unions that are authorised by the Prudential Regulation Authority (PRA) are protected up to £85,000 per individual, per authorised firm. This includes money held in current accounts, savings accounts, cash ISAs and fixed-term bonds.

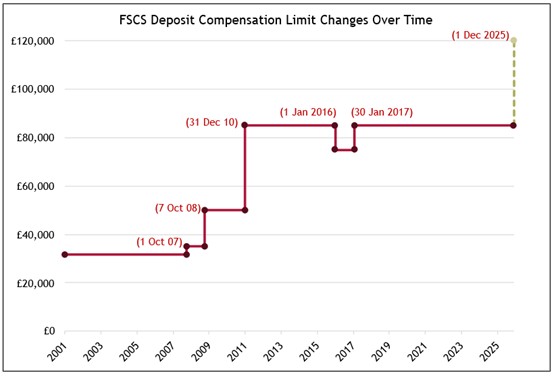

From the 1st December 2025, that protection will increase to £120,000, marking the first rise in over eight years. The current £85,000 threshold was set in 2017 and has remained unchanged since, despite changes in the economic environment and the cost of living.

This latest increase is part of the PRA’s broader work to keep the regulatory framework up to date and aligned with today’s conditions. Under the Deposit Guarantee Scheme Regulations 2015, the PRA is required to review the FSCS deposit limit at least every five years.

Following a consultation launched in March 2025, the PRA confirmed the updated limit on the 18th of November, giving firms and consumers notice ahead of the December implementation.

Why Now?

A key driver behind the change is inflation. The real value of the £85,000 limit has been gradually eroded since it was last updated. By raising the protection level to £120,000, the PRA is effectively restoring the value of cover to where it was intended to sit back in 2017.

Sam Woods, Deputy Governor for Prudential Regulation and CEO of the PRA, commented:

“This change will help maintain the public’s confidence in the safety of their money. It means that depositors will be protected up to £120,000 should their bank, building society or credit union fail. Public confidence supports the strength of our financial system.”

The FSCS exists to reduce the risk of consumer loss and promote trust in the financial system. Enhancing that protection sends a strong signal that regulators are acting to ensure the framework keeps pace with the economy.

A Look Back at the History

The FSCS deposit protection limit has evolved in response to financial crises, regulatory changes and economic pressures. Initially set at £31,700 in 2001, the limit provided 90% coverage up to £35,000. But as public confidence wavered during the 2008 financial crisis, the system was overhauled.

In October 2008, the limit rose to £50,000, and protection was extended to cover 100% of eligible deposits up to that amount. Just two years later, in December 2010, the threshold increased to £85,000 to align with the EU’s harmonised €100,000 limit.

A temporary reduction to £75,000 occurred in January 2016, following exchange rate movements after the Brexit vote, but the PRA restored the £85,000 level in 2017, using newly gained discretion under post-crisis reforms.

Source: FSCS Publications

These shifts reflect the FSCS’s role not just in protecting depositors, but also in maintaining confidence in the banking system. The limit must remain responsive to inflation, currency movements, and the economic climate, and the latest increase continues that pattern.

Temporary High Balances Also Get a Boost

From 1 December 2025, the protection limit for certain temporary high balances will also rise, from £1 million to £1.4 million. This applies to qualifying life events such as selling a property, receiving an insurance payout or inheritance, or getting a redundancy payment. These balances are covered for up to six months and are designed to give short-term reassurance during significant financial transitions.

What This Means for Consumers and Treasury Professionals

This change increases the amount of protection available, but it's still important to understand how the FSCS applies in practice.

The limit applies per person, per authorised firm. So, if you hold accounts with multiple brands that operate under the same banking licence, those deposits are combined for FSCS purposes.

For example, holding £100,000 in Brand A and £50,000 in Brand B may only be protected up to £120,000 if both brands are part of the same banking group and share a licence. This remains a critical consideration for depositors, particularly those with larger balances or managing funds on behalf of others.

Trust in the financial system relies on strong consumer protection, and the increase in the FSCS deposit limit is a practical step to help reinforce that trust. It also reflects the need for regulation to evolve in line with the wider economy.

While the increase will be welcomed by many, it also serves as a prompt for individuals and institutions to review how their deposits are spread across providers.

For treasurers and finance officers, particularly in charities and smaller public authorities such as town and parish councils, this could be an opportunity to reassess counterparty exposure and ensure they remain within FSCS limits where appropriate.

Please email us at treasury@arlingclose.com to discuss how the changes may affect your organisation, or if you’d like support reviewing your deposit strategy and managing counterparty exposure in light of the updated FSCS protection limits.

19/11/2025

Related Insights

What is the FSCS and is My Authority Covered?