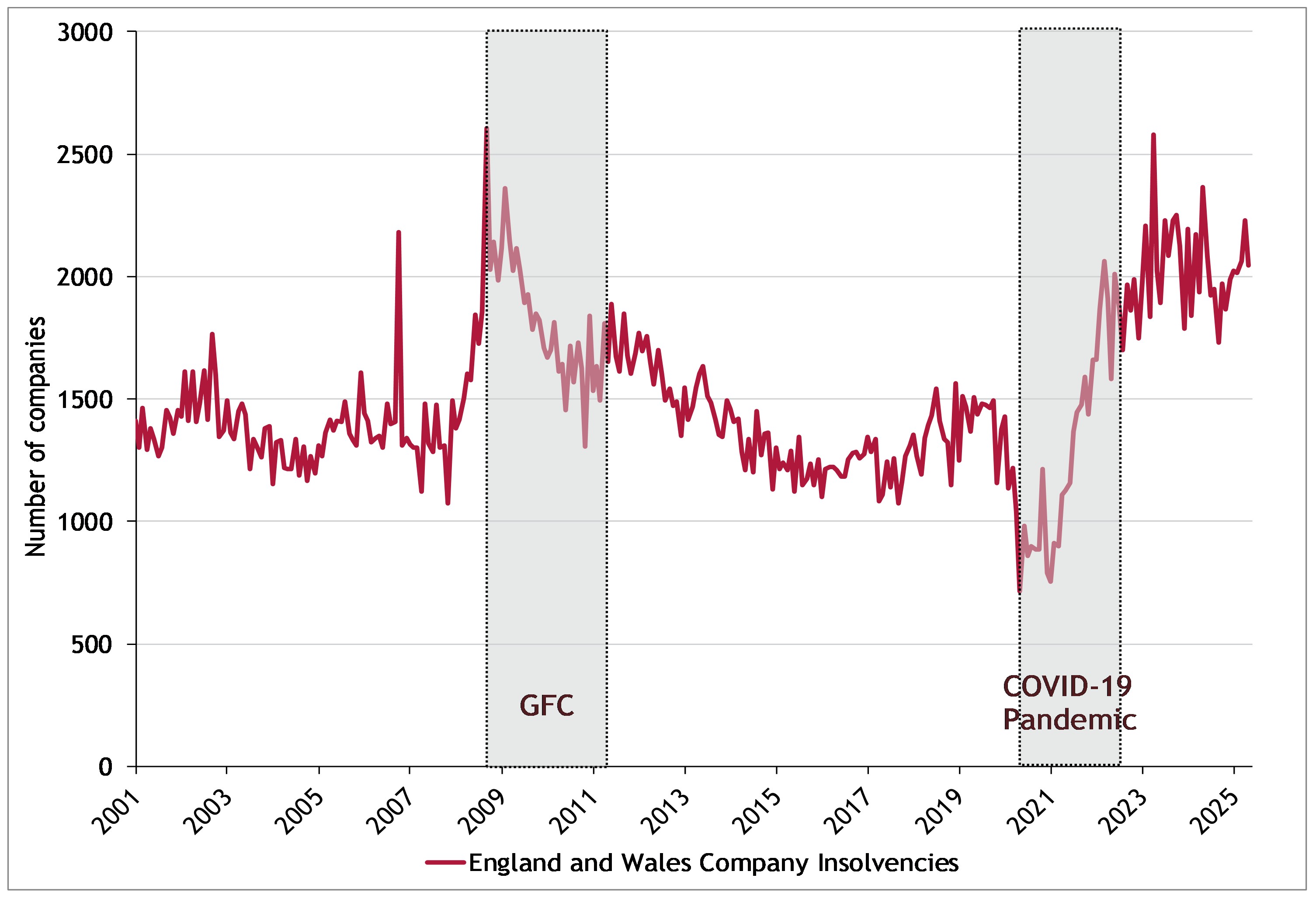

Company insolvencies in England and Wales remain stubbornly high, with more than 2,000 firms failing each month (2,024 in June, 2,230 in May, 2,062 in April…). The post‑pandemic recovery has been hampered by persistently high interest rates, rising wage and energy costs, and weak consumer confidence. Many businesses are operating on thinner margins, with limited cash reserves and increased reliance on short‑term borrowing. The result is a fragile environment in which well‑intentioned investments or loans can quickly turn into unrecoverable losses.

Source: UK Government, Company Insolvency Statistics (latest release available at gov.uk/company-insolvency-statistics)

For both councils and corporates the stakes are high. Whether it is providing a loan to stimulate local growth, investing in a regeneration scheme, or appointing a contractor for a major project, decisions are being made against a backdrop of heightened financial risk. Too often funding decisions rely on optimistic forecasts, incomplete financial information or an unclear view of the counterparty’s true risk profile. In response, Arlingclose works with local authorities and corporate clients to ensure that lending and investment decisions are underpinned by robust, independent analysis rather than optimism, making thorough due diligence a vital part of every transaction.

What comprehensive due diligence looks like

Arlingclose recently supported a local authority considering a multi‑million‑pound loan for a significant regeneration project. Rather than simply approving the funding request, the authority commissioned a full independent review. We analysed the borrowing entity’s expected cash flows, operational risks and financial resilience, applying a structured approach to assess credit strength and default risk.

The findings were used to calculate market‑aligned interest rates for both secured and unsecured lending. This ensured the lending terms complied with the Subsidy Control Act while also properly compensating the authority for the risks involved. We also modelled the impact on the council’s accounts, including its Capital Financing Requirement and Minimum Revenue Provision, ensuring the transaction would meet accounting and prudential borrowing rules.

Security was a critical consideration. The projected value of the completed asset was compared with the size of the loan, revealing that the debt could not be fully secured without a mix of equity and debt funding. Arlingclose advised on appropriate loan‑to‑value limits, debt service cover ratios and cash reserve requirements to protect the lender’s position throughout the life of the loan.

Alongside the borrower review, the proposed operator of the asset was assessed in depth. This involved more than just reviewing accounts. We looked at the operator’s financial position and group structure, but we also considered operational evidence from similar assets it manages – occupancy rates, customer feedback and the performance of comparable sites. Reviews and performance data gave a clear picture of the quality of service delivered, as well as the commercial success of those operations. This wider perspective helped the council to understand not just whether the operator was financially stable, but whether it was likely to deliver a successful, well‑run facility.

Applying the same rigour for corporate clients

This level of scrutiny is just as valuable for private businesses making high‑value contractual commitments. A recent corporate client engaged Arlingclose to assess a contractor bidding for a £25 million London development. We carried out a full financial analysis of the contractor and its parent company, reviewing profitability trends, liquidity, gearing, historic performance on similar projects and operational capacity.

Our findings confirmed that the contractor had the financial strength and experience to deliver the project but also identified areas where additional safeguards could provide reassurance. We advised on standard protections such as performance bonds, parent company guarantees, staged payments and retention arrangements to manage cash flow exposure during construction.

By combining financial scrutiny with practical recommendations, we enabled the client to appoint its contractor with confidence, knowing that the decision was backed by a clear understanding of the risks and how best to mitigate them.

Why this matters more than ever

The economic climate demands more than just optimism. Persistently high insolvency rates reflect the reality that many businesses are one shock away from financial distress. In this environment, it is no longer enough to ask, “can we do this?” – the real question is “should we, and on what terms?”

Thorough due diligence provides the answers. It ensures that default risk is fully understood, that security is sufficient and enforceable, that pricing reflects the risk taken, and that all legal and accounting obligations are met. Without this, lenders risk under‑compensated exposure, losses due to inadequate security, reputational damage and potential breaches of subsidy control rules.

Making confident, well‑informed decisions

If you are considering lending to a business, funding a regeneration scheme or appointing a contractor for a major project, independent due diligence can highlight key risks and help you make informed decisions. We can also compare shortlisted contractors and advise which counterparties appear more creditworthy and financially resilient.

To discuss how Arlingclose can support your due diligence process with clear, evidence-based advice, please contact pmarshom@arlingclose.com.

Related Insights