Central banks have shifted policy. The fear of embedded inflation expectations has led the Federal Reserve, ECB, and to a lesser extent, the Bank of England, to target current inflation rather than medium term inflation. This is in the belief that it is current, not expected, inflation that drives the public’s inflation expectations. If expectations are elevated, employees increase wage demands and businesses find it easier to pass on price increases. Inflation becomes much more difficult to control.

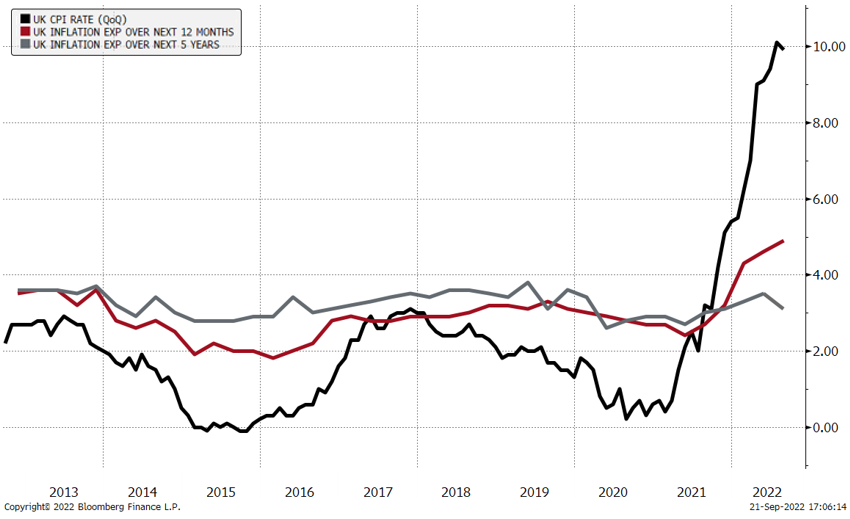

Current inflation is high, absolutely no doubt about that. It has been primarily driven by supply bottlenecks and reduced labour supply arising from the pandemic, and surging energy and food prices driven by the Ukraine war and Russia’s retaliatory stance for the resulting sanctions. These issues amount to various price shocks. While household inflation expectations for the year ahead have indeed spiked, medium-term expectations have remained anchored close to inflation targets. It suggests that either households know that current issues are relatively temporary and/or households had faith that policy would be tightened to bring inflation down.

Either way, monetary policy had to act, if only to meet the self-fulfilling prophecy. It suggests that the public has significant faith in the current monetary framework in the EZ, UK and US. But, given the anchoring of expectations, why are policymakers pushing expectations ever upwards, at the same time as significantly tightening policy? There are clearly issues of credibility here – central banks possibly feel a contributor to high inflation due to the big ease in policy during the pandemic. So, they are protecting themselves and current frameworks. A case in point, UK governor of the Bank of England having to defend the inflation targeting framework, despite the average CPI rate since BoE independence being 2%, bang in line with target.

This brings me back to the first paragraph. Monetary policy is a lagging tool. It works on demand over the medium term, not immediately. Note also, monetary policy affects demand, not supply; it will not solve the current issues driving inflation, it can only affect the other side of the balance. Monetary policy is therefore used to target medium term inflation. Or used to be.

By targeting the current supply-driven inflation, and so effectively targeting current levels of economic activity, policymakers need to move significantly to shock economic players, to bring about an immediate decline in demand. The labour market in particular is dead in the sights of the Federal Reserve. How do you balance a shortage of labour? Either by reducing demand for labour or increasing supply of available labour. Monetary policy can only do this by reducing household demand and increasing unemployment.

The issue here is by how much? Inflation will inevitably fall. If commodity markets decline quickly due to growth concerns, inflation could fall sharply. Where interest rates have been tightened sharply due to fears of embedded expectations, we will quickly find policy far too tight, with economic growth implications for the next two to three years. Unemployment will have risen and remain elevated, and demand will therefore remain restrained. US policymakers are now suggesting high interest rates could persist for some time to tame the inflation beast. But is there really an inflation beast or just a price shock working through the system. After all, wage growth has remained below inflation and shows little sign of taking off – households are facing declines in real income. Medium term inflation expectations remain anchored. Given this backdrop, will policymakers ever believe the inflation threat is gone?

With the focus squarely on inflation, there is no-one to rein in monetary policymakers. High inflation cannot be condoned because of the feared consequences, so the gallery is only going to ask why more was not done. Central banks have to maintain credibility at all costs and are riding a wave of consensus – market expectations support central banks and central banks support market expectations. Onwards and upwards we go.

The Federal Reserve’s fervour to bring down current inflation is already causing issues for the global economy due to the strong US dollar. If growth tanks, then it will be agreed it was a necessary consequence.

But we could ask, was it an avoidable one?

Related Insights

Funding in a Volatile Market – A Case Study and 10 Top Tips

Multi-Asset Investing and Inflation

How long will gilt shocks continue?