How do successful treasury managers navigate current rate volatility and mitigate rising interest costs? In this Arlingclose Insight we set out how we have helped one of our London Borough clients achieve a low-cost debt portfolio.

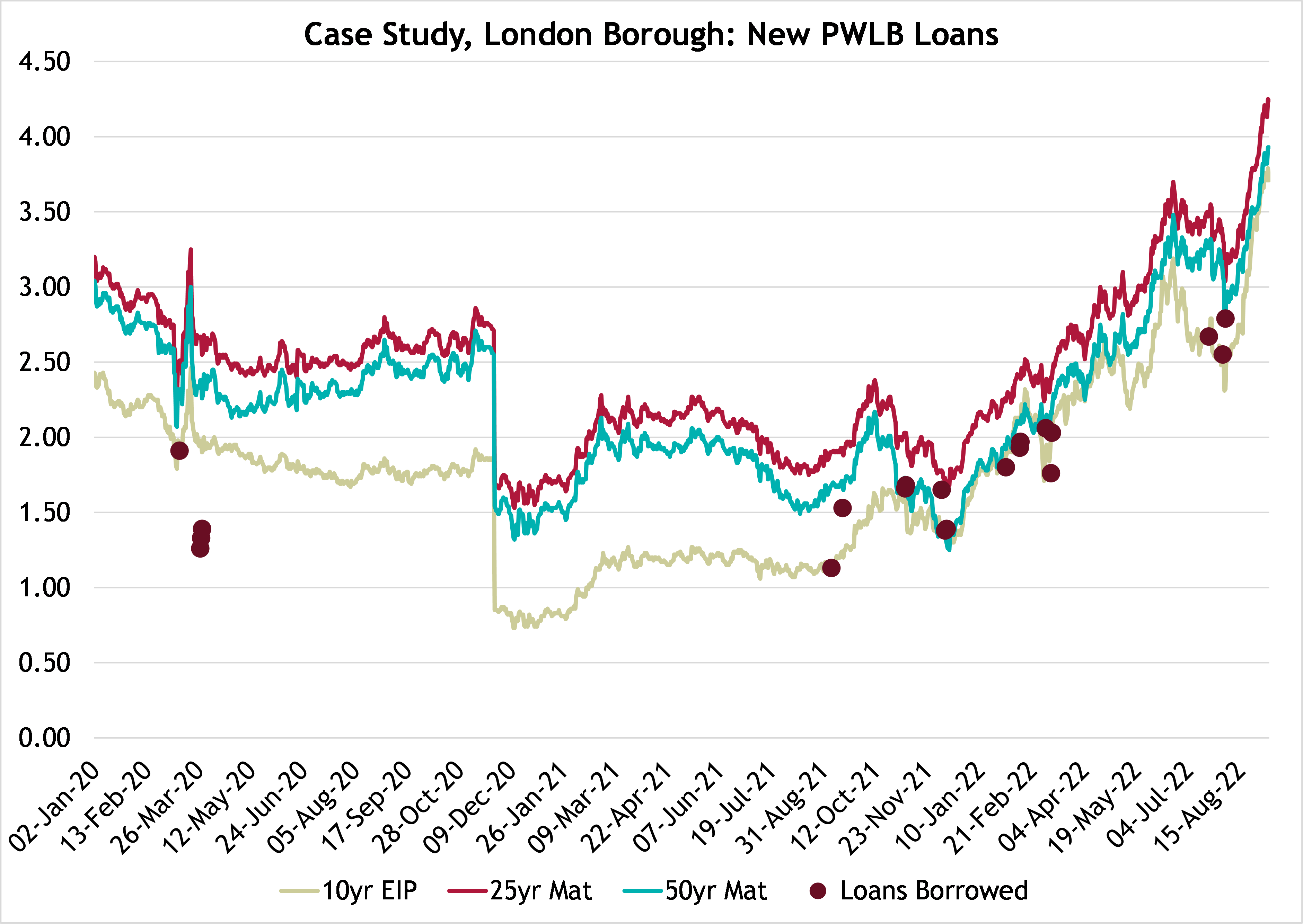

The chart below shows the timing of the Council’s borrowing decisions against movements in Public Works Loan Board rates since 2020. The Council has managed to beat the market, securing £290m of debt with an average life of 26 years at an average weighted cost of 1.9%. This compares to an average PWLB rate of 2.44% over this time, representing a total interest saving of £41m.

How did they do it? Below we list 10 tips to help deliver success:

- Define Objectives

While the Council wanted to “minimise” interest costs, this objective has been managed pragmatically. With a relatively limited range of financial instruments at their disposal, successfully managing risk over multi-year projects is not easy. Simply borrowing a large slug of debt in advance may sound like the solution but accurately estimating the funding requirement and timing of expenditure make this an impractical solution and can create additional costs and risk. The more achievable objective of delivering funding within a defined budget has helped inform decision making and set achievable interest rate targets.

- Liability Benchmarking

Regularly updating the liability benchmark has driven borrowing activity. The recent increase in consumer prices has not only led to higher rates, but also challenged the delivery of local authority projects, creating an uncertain underlying funding requirement. An up-to-date liability benchmark has informed decision-making on the amount, timing, term and repayment structure of debt, with subsequent analysis identifying interest rate exposure and risk mitigation strategies.

- Be Prepared

The Council set out a clear strategy and funding objectives, both within the approved treasury management strategy statement but also at an operational level amongst treasury officers and dealers. This helped transfer theory to practice, with officer’s alert to funding opportunities and the borrowing requirement. The council also has access to an online tool with live feeds to market data; this Identifies the current funding requirement and net exposure to interest rates, aiding swift decision making (speak to your treasury management advisor for details).

- Approvals and Process

The most beneficial source of funding for the Council, PWLB debt, was identified early. While private sector alternatives can offer different benefits, the ease of access to PWLB loans has facilitated the timely implementation of the strategy. Approvals were verified at an operational level to allow swift execution, with PWLB dealer approval maintained and the Delta “certainty rate” spending returns kept up to date.

- A flexible approach

While the strategy was well defined, it required pragmatic implementation in a fast-moving market. Over recent years the Council had preferred to reduce cash balances and maintain these at a minimal level. However, opportunities to take funding at low rates materialised with little notice, notably when the COVID crisis hit and HMT reduced margins for HRA loans in March 2020. Analysis, and to some extent instinct, identified that securing a lower rate on long-term funding would take priority over incurring a cost of carry; waiting until you need the debt may mean missing out on lower rates. A flexible approach was required, regarding the structure of funding as well as the timing of decisions. While the liability benchmark provided a guide on appropriate durations and loan structures, the shape of the yield curve presented lower cost alternatives. An adaptable interpretation of this “benchmark” provided our London Borough some leeway to secure appropriate funding at more attractive rates at, using a EIP and maturity loans at different points of the curve.

- Set trigger rates

Setting trigger rates for action aided strategy implementation, providing a clear cue for action. There are a few different approaches here, but we reasoned a trigger set higher than current rates would result in borrowing being undertaken just as rates move higher, not always the best option. Conversely, a trigger rate set below currently may never be hit in a rising market. We found setting an acceptable range in which funding could be drawn worked well, with a higher amount of debt borrowed when the lower bound was achieved. The upper bound acted as a “stop loss” and was set at the budgeted level for borrowing rates.

- Practical interpretation of interest rate forecasts

A sensible approach to interest rate forecasts and trigger rates was adopted. If PWLB rates were within a few basis points of the trigger, but intraday increases in yields suggested PWLB rates would open higher the next day, proactive action was taken. Stepping back and taking a holistic view of the strategy was also useful, considering the capital programme over three years and comparing the average rate of funding already taken against budget. In today’s market, a rationale and sensible approach may entail pausing long-term funding for a while, particular as the £290m fixed rate debt taken to date has significantly mitigated future rate risk.

- Monitor rates

Volatile rates required a watchful eye, opportunities to borrow can disappear quickly so prompt action was required. The PWLB midday reset also provided an opportunity to shave a few basis points off funding costs, with tactical decisions to borrow before or after the 12:30 rate reset. The strategy was also reviewed frequently, with regular meetings and calls between Arlingclose and the Council.

- Alternative funding

While short-term “LA to LA” rates are currently relatively high, refinancing these later may prove beneficial in the longer-term if PWLB rates fall. A balanced approach to risk was followed, leaving scope to respond to a range of different rate outcomes and a constantly changing underlying funding requirement. While forward starting loans were also considered, margins were higher than PWLB debt, often well above 1%. The Council deemed it quicker, easier, and cheaper to borrow PWLB debt in stages and invest the cash until required.

- Prepayments & refinancing

Current higher interest rates mean the council is reviewing prepayment opportunities within the portfolio, particularly on commercial debt and LOBOs. This opportunity could enable the council to further eliminate risk and make interest savings, offsetting higher rates elsewhere.

Arlingclose provide a range of services to help authorities develop and implement funding strategies, if you would like to find out more, please contact dblake@arlingclose.com.

Related Insights: