Pension funds in the UK are required to apply rigorous and transparent valuation methods for their financial assets, grounded in accounting standards, regulatory guidance and sector-specific codes of practice. These valuation rules underpin not only the integrity of scheme reporting but also the robustness of funding assessments and investment governance.

UK pension schemes typically report under FRS 102, the Financial Reporting Standard applicable in the UK and Republic of Ireland. This is supplemented by the Pensions Statement of Recommended Practice (SORP), maintained by the Pensions Research Accountants Group (PRAG). Together, these frameworks mandate that financial assets be measured at fair value as at the reporting date. For listed securities, this is usually the bid price quoted on a recognised exchange. Unquoted and complex assets require more judgement and often involve modelling or third-party valuation, something Arlingclose has extensive experience undertaking.

The fair value approach aligns broadly with IFRS principles, and the SORP establishes clear expectations for how different types of assets should be valued and disclosed. Transaction costs, for instance, are not included in fair value measurements but must be disclosed to improve transparency. Pooled investment vehicles, private equity, infrastructure, derivatives and similar assets are all subject to these requirements, even when external pricing is not readily available.

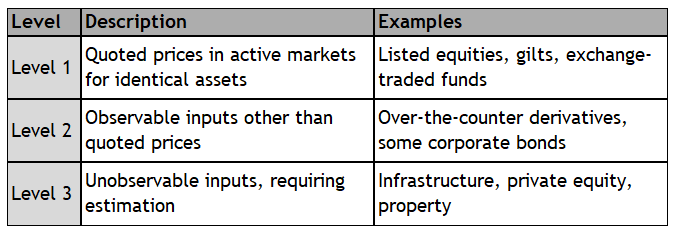

A common classification structure used in financial reporting is the fair value hierarchy, which categorises assets based on the nature of the inputs used in their valuation. This is crucial for trustees and auditors to assess the quality and reliability of asset valuations.

Loans to unlisted companies may be valued using a combination of level 2 and level 3 inputs. For example, the assessment of creditworthiness is likely to involve significant estimation and hence be level 3, but the relevant credit spread can then be observed in the market, a level 2 input.

The Pensions Regulator does not prescribe specific valuation techniques but expects schemes to apply consistent and appropriate methodologies. Trustees must be able to understand and challenge valuation approaches, particularly in the case of illiquid or esoteric assets where transparency is weaker and estimation risk is higher. External audit scrutiny also plays a key role in validating valuations and disclosures, a consistent and appropriate methodology is something Arlingclose can provide.

For public sector schemes such as those within the Local Government Pension Scheme (LGPS), the same principles apply, though guidance from CIPFA and statutory reporting requirements also come into play. LGPS funds frequently invest through asset pools which adopt centralised valuation policies, although each fund remains responsible for the integrity of its own reporting. Increasing use of Level 3 assets across all pension schemes has heightened the importance of robust valuation governance and disclosure. Arlingclose can provide a robust, tried and tested methodology that supplies clarity and comprehensive valuation of assets.

In summary, the valuation of financial assets in UK pension schemes must be grounded in fair value principles, supported by an appropriate hierarchy of inputs, and subject to clear disclosure. Trustees should remain vigilant to the quality of valuations, particularly in relation to alternative assets, to ensure financial statements accurately reflect the scheme’s financial position and to support sound funding and investment decisions, something Arlingclose can provide in detail. For more information, please contact Stuart Jones sjones@arlingclose.com.

Related Insights