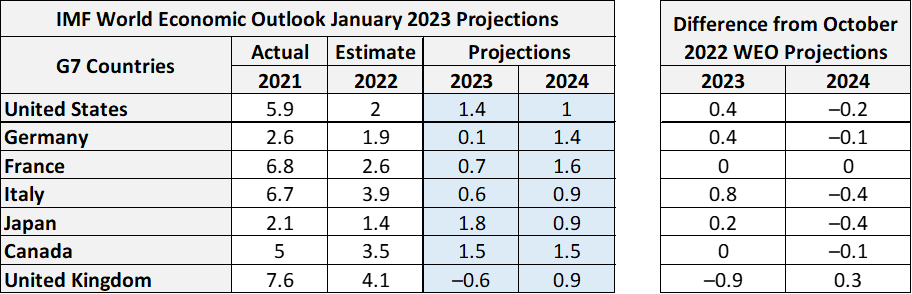

Last week the IMF produced its regular report on the economic outlook for the World. This time turned out to be a scathing forecast for the UK economy. But are these gloomy forecasts for the UK really justified? The report suggests the UK will be the worst performer of all G7 nations, and is a significant downgrade from the previous projection too.

It should be noted that other major forecasters are all fairly negative, the Bank of England, Office for Budget Responsibility and the CBI are all somewhat negative. But, perhaps some of these forecasts should be questioned with a bit more scrutiny, and not viewed with the typical British pessimism. Below is a summary of the new forecast from the IMF in January 2023.

In the main, the forecast for major economies has improved. This reflects the IMFs view of reduced supply chain issues from removal of Chinese lockdowns, reduced or improving inflationary pressures, and supposed pent up demand in major economies.

The summary above suggests all G7 economies will grow except the UK. The UK is forecast to contract 0.6%, and Germany grow 0.1% in 2023. As with all forecasts, this should be taken with a pinch of salt. Forecasts are useful, necessary even, but no forecast is going to be exactly correct. It is still important to see how close they can get, as it can influence decision making now.

But the IMF has a bad track record. After Brexit, the IMF expected a significant downturn from Brexit that never materialised. There is also an element of hypocrisy, last year in 2022 the IMF had plenty to say about the Kwarteng Mini Budget, the IMF scolding fiscal loosening. However, with this update, they have downgraded the forecast due to fiscal tightening. Which is it Mr IMF, what would make you happy?

There is also the argument that the IMF is using out of date data. The forecast assumes higher and elevated energy costs as one of the major reasons the UK will take this downturn, ignoring the fact energy prices have been falling for quite some time! Furthermore, if higher energy costs are what is driving lower growth in the UK, why is this not also affecting growth figures in Germany, France and Italy who arguably are more exposed to these same risks? Why would the UK be an outlier?

Supply chain upheaval & cost of lockdowns that were supposed to be paid for after the pandemic, are also not unique to the UK. A subsequent insight in roughly 12-months’ time will hopefully vindicate this writers view that the UK simply won’t be at the bottom of this performance table.

It should also be noted, growth figures have been better than expected. The perpetual pessimism about the UK economy will likely lead to positive surprises through this year. The subsequent OBR forecast could be much more positive. This could have a significant impact on gilt yields and subsequently on local authority borrowing rates, keep an eye out for further updates on this!

Related Insights

Inflation - Written in the Mars?