Recent “capitalisation directions” provide further evidence of central government support for local authorities. This latest round of assistance takes the pressure off budgets in the short-term, providing breathing space while authorities reorganise their finances. While no free lunch for recipients, it provides a strong demonstration of central government support for local government, underpinning credit worthiness across the sector.

Government support for all local authorities

Central government support to local authorities during the COVID-19 pandemic has been significant. In March and April 2020, the government provided £3.2 billion of emergency grant funding and over £5 billion of cashflow support. This has been followed up with additional support packages announced in July, October, December and then most recently in February 2021. Some of these additional support measures have included:

- A new scheme to reimburse councils for lost income from sales, fees, and charges until June 2021, where local authorities, having absorbed the first 5% of relevant irrecoverable income losses compared to budgets, receive compensation from government covering 75% of remaining losses

- The provision of almost £3 billion in non-ringfenced grants

- The provision of £670 million local council tax support grant

In addition, the Local Authorities (Collection Fund: Surplus and Deficits) Regulations 2020 came into effect in December. These regulations allow local authorities with Collection Fund deficits caused by tax income being lower in 2020/21 than originally estimated to spread the deficit over three years rather than the usual one.

Government support for particular authorities

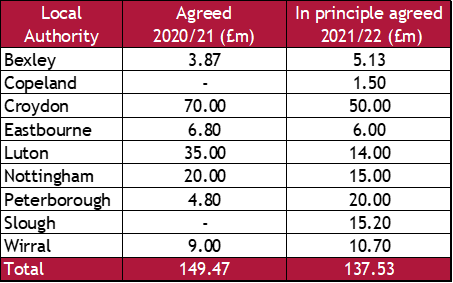

Earlier this month the UK government published details of the capitalisation directions granted to those local authorities that requested exceptional financial support during the COVID-19 pandemic. Of those requesting support, seven authorities had capitalisation directions agreed for the 2020/21 financial year and agreed in principle for 2021/22, while two others had support agreed in principle for 2021/22 only.

The government assistance comes with strings attached, including requiring each authority to pay off the capitalisation over a period of 20 years via MRP, to submit to an external assurance review, and pay a 1% premium on borrowing taken from the PWLB up to the amount capitalised.

Arlingclose considers the sector’s creditworthiness to be generally strong, and the support offered by the UK government under the capitalisation directions helps underpin our view that central government will assist local authorities in financial trouble. We therefore believe these measures are credit positive.

Strong Credit Quality

The support highlighted above, combined with a strong local government financial framework, continue to underpin local authority credit worthiness. Indeed, some authorities rated by Moody’s enjoy the same Aa3 rating as the UK sovereign, with other rated just one or two notches below.

Zoe Jankel, Senior Analyst at Moodys, expanded on this during a recent “Trending Treasury” webcast with Arlingclose. Asked what would need to change to alter the uplift applied to local authority baseline credit assessments for government support, Jankel commented “we would have to see central government stepping back from the sector, which we haven’t seen”.

Local authorities are obliged to supply essential services to their communities, a role highlighted during the pandemic. It would appear appropriate for central government to provide external assistance, if required. While most authorities remain financially resilient, evidence suggests that if central government support is required this will be forthcoming.

Related Insights: