The effect that the coronavirus pandemic has had on global financial markets cannot be understated. The sudden implementation of lockdown measures plunged many businesses into very unstable financial positions and prompted huge falls in the financial markets. Sudden macroeconomic shocks such as these highlight the importance of a robust credit analysis process and can create a good opportunity to consider how these processes can be improved.

Credit Ratings

There are many tools at your disposal when it comes to credit analysis, one of the most common of which are credit ratings. Credit rating agencies provide large amounts of technical analysis which can be easily digested at a glance through the use of simple alphanumeric ratings. The majority of credit ratings are provided by “the Big Three” rating agencies: Moody’s, S&P and Fitch who provide more than 80% of all ratings between them so it is very likely that you will make use of them at some point or another.

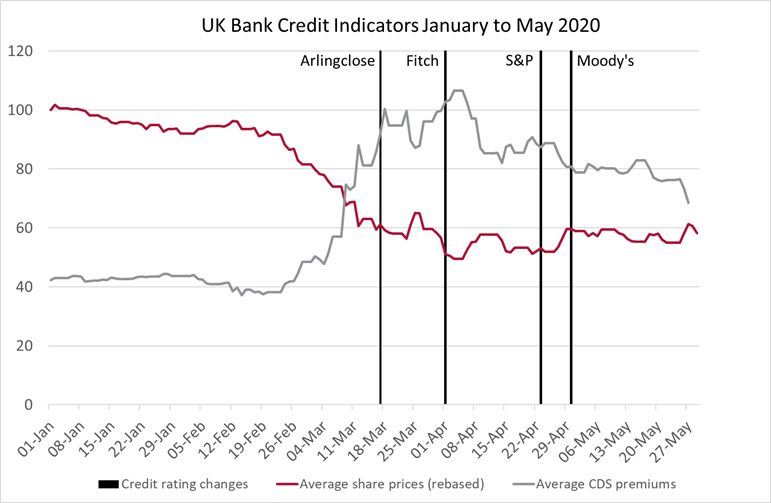

While credit rating agencies perform very useful and in-depth analysis on businesses and help to form a view on regional market strength, they are not without their issues and an overreliance on them can be problematic as they can be slow to change ratings in times of market turmoil as demonstrated on the graph below. Additionally, as local authorities have been moving increasingly towards using Money Market Funds (MMFs) and placing local authority deposits, credit ratings become less useful in these areas. While there is some variation between individual MMFs, generally they are all a very high credit quality due to the types of investment instruments that they purchase. Similarly, while there is some variation in local authority credit worthiness very few pay to be rated individually by an agency and overall, they are all of a strong credit quality due to financial backing from the UK government, the PWLB acting as a lender of last resort and the requirement to maintain a balanced budget.

Credit Default Swaps

Credit Default Swaps (CDS) are another useful tool to incorporate into your credit process, even if you don’t buy them directly. What you can do is monitor the CDS prices as rising prices indicate that the market perceives a higher level of risk for that institution or for a specific region (if the prices of all banks in that region rise simultaneously). For example, as you can see on the graph above the CDS prices for all UK banks began to rise in early March 2020 as the effects of the coronavirus pandemic put stress on markets and led to higher risk of defaults on bank loans. This demonstrates one of the key benefits of CDS which is their fast-reacting nature due to daily pricing. If you relied solely on credit ratings, you would have been waiting until April for the first rating change whereas CDS prices began to rise a month earlier.

Share prices

Movements in share price have similar benefits to CDS in as much that they are quick to react as the price is determined on the open market and we can monitor changes in the share value which may indicate changes in the perceived level of risk. However, share prices are not a clear-cut indicator of creditworthiness as there are competing interests between shareholders and depositors. For example, a move by the bank which increases their level of credit risk but generates higher returns may increase the share price as this would be beneficial to shareholders despite it decreasing their level of creditworthiness.

Balance sheet analysis

Digging a bit deeper into the year-end financials of the banking institutions gives an extra insight into how creditworthiness has changed over the year. The key here is to understand where your investment sits within the liability structure – how much is below you and will absorb losses first, and how much is above you and unable to absorb losses before you are wiped out. We use the CET1 and leverage ratios within our bail-in analysis which demonstrates what percentage of risk-weighted assets would have to be lost before local authority deposits would be at risk of being used to cover the damage.

Analysing the profit after tax (the excess income after expenditure) can also give an insight into the bank’s sustainability while the level of impairments (money put aside to cover losses from loans) can be an indicator of potential upcoming financial stress.

Summary

These are some of the tools that contribute to a strong credit assessment process, but they should be used in conjunction with other important factors as well. Putting in place appropriate guidelines such as choosing appropriate investment instruments as well as setting out suitable time and counterparty limits will help to minimise the risk of any loss given default or liquidity issues.

At Arlingclose we regularly monitor all the above risk measures as well as macroeconomic readings and press releases to form an overall view of the creditworthiness of institutions that we add to our lists. This credit analysis process is at the core of our service and allows us to provide be confident in the advice we provide. If you have any questions on our credit process or would benefit from assistance in developing your own, please get in touch with the Arlingclose team by emailing info@arlingclose.com.