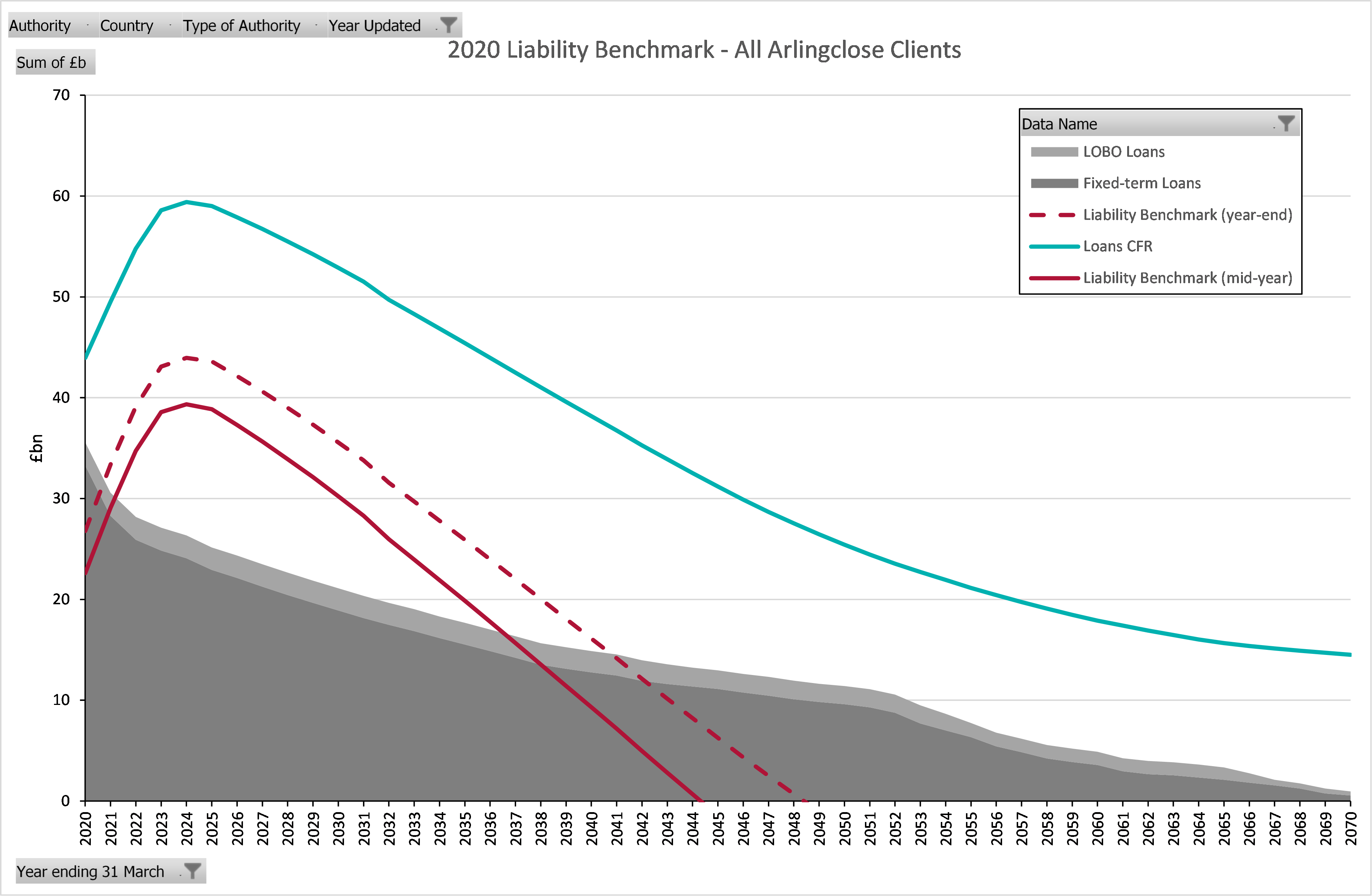

Those local authorities who work with us on a regular basis will be familiar with the liability benchmark: a tool we use to plan for what future borrowing is required by the organisation. Over the last two years Arlingclose has been able to put together all of the liability benchmarks for our clients. The combined position at 31st Match 2020 looks like this:

As a guide for the uninitiated: the blue line represents the need to fund capital expenditure through borrowing (the Capital Financing Requirement or CFR). The red lines represent the need to fund capital expenditure through borrowing once reserves and working capital surplus’ (or deficits) have been taken into account – this is actually the real need to borrow which CIPFA have defined as being the Liability Benchmark. The dashed red line represents the position at year end and the solid line represents the average mid-year position. The grey shaded areas show actual loans. When the grey area falls below the red lines this infers a borrowing need. As you can see from the graph those local authorities that we advise are collectively expecting to need to borrow in future years so we can expect borrowing activity to be busy.

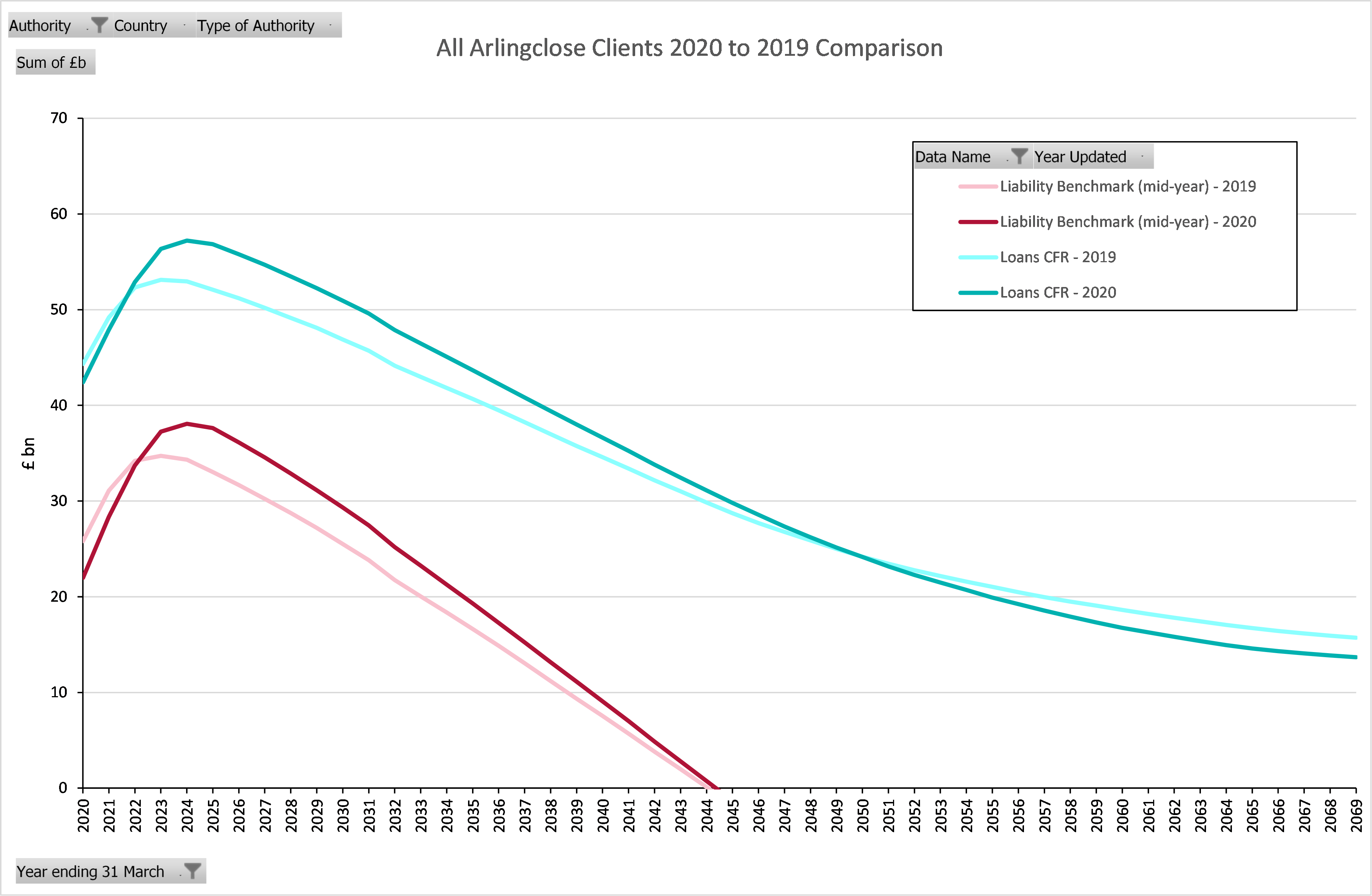

What we have also been able to do is put together what this graph looked like last year and then a year earlier. This is shown below:

Darker shades give the picture as at last year and lighter shades the year before that. The main feature that stands out is the shift of the graph upwards and to the right. Local authorities over this two year period monitored are expecting to borrow increasing amounts, but to do it a bit later. The points where the lines hit the y-axis show the difference between the previous years’ projections in the lighter colour and last year’s actuals in the darker. This shows that clients actually needed to borrow a bit less than they were expecting - a common occurrence and one which is caused by capital projects taking longer than planned (‘slippage’) and reserves which shrink less than expected or grow. This demonstrates that whilst it is fine for local authorities to plan for increasing borrowing requirements, they should bear in mind that these may happen later than expected so having some flexibility in borrowing arrangements (for example having a proportion of debt in short term loans) is recommend.

A recent CIPFA code consultation has suggested making this liability benchmark a future prudential indicator, perhaps making it an even more important tool going forward.

Related Insights: