This time last year, the Ministry of Housing, Communities & Local Government published updated statutory guidance on local government investments. The rationale behind the update was the increasing levels of investment in commercial assets by local authorities, so it was considered that new guidance was required. The Local Government Act 2003 is clear that local authorities are required to have a regard of this investment guidance and so the updates are important for English authorities to be aware of.

One new requirement that has generated much discussion, is the need for local authorities to develop quantitative indicators to allow Councillors and the public to assess the total risk exposure resulting from its investment decisions.

Local authorities should include the new disclosures in their 2019-2020 investment strategy, particularly if they have non-financial investments which generate revenue income and have funded these through borrowing. For example, investing in property to generate a profit which then supports service budgets, is considered a non-financial investment under the MHCLG guidance.

In the view of the new guidance, English local authorities need to be cautious about how much debt they take out in relation to net service expenditure and should not become too dependent on commercial income to bridge the gap between service expenditure and other locally derived income such as: fees and charges and Council Tax.

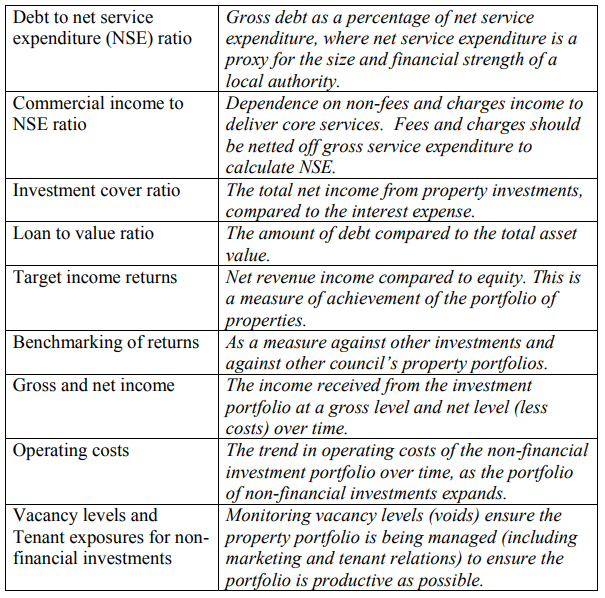

Many councils have been undertaking large commercial property transactions in order to generate revenue to meet service delivery needs. The MHCLG guidance suggests that as a minimum the following indicators are calculated and disclosed in the annual investment strategy.

Source: Statutory guidance on local government investments (3rd Edition)

Most of the indicators should be relatively simple for treasury and capital teams to calculate, with much of the information available in the annual statement of accounts or included as part of the investment decision making process. However clients may find that some of the indicators require more work than others -Arlingclose is always available to assist in this case.

For example, the indicator covering the benchmarking of returns may be more difficult to assess and with that in mind we are considering adding this to part of our benchmarking service. We would benchmark client’s indicators against our overall client universe as well as by authority type and compare the returns from commercial property investment against the returns from other asset classes. If you can provide us with your investment strategy documents, we can undertake this benchmarking exercise.

If you wish to take part in this benchmarking exercise, please send your investment strategy and relevant indicators to rpatel@arlingclose.com.