As we await with baited breath the outcome of the PWLB consultation exercise many local authorities with debt for yield aspirations in their capital programmes may be looking at the possible alternatives for funding these investments or maybe even looking to unlock the value of their existing asset base to raise capital funds.

Income Strip transactions could be just one of the options available in a brave new world of local authority capital funding.

What is an income strip deal?

Essentially, these are a forward funding arrangement where investors acquire property related assets which are then sold back to the occupier for a nominal amount (normally £1) at the end of the lease term.

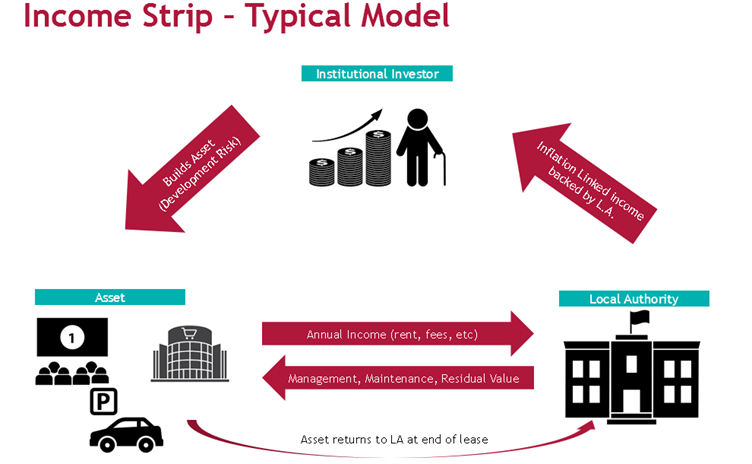

For illustration purposes an income strip deal could look like this:

Traditionally these types of transactions were limited to sale and leaseback structures and whilst these are still common income strip is now the more popular and widely used by the public sector. The subtle differences between the two structures are as follows:

- Sale and Leaseback – The owner occupier sells a freehold interest to an investor and signs a long lease with that same investor. Rents rise each year by inflation giving the investor a strong indexed linked return and potential growth in the assets value in exchange for the initial upfront payment. Hotels are typically funded via this method and leases are normally for a 20-year maximum period.

- Income Strip – The owner occupier also sells the asset but retains the right to repurchase it at the end of the lease for a nominal amount. Investor obtains the index linked return but has no exposure to the underlying value of the asset. This type of structure is often used to fund student accommodation and leases are normally for a minimum of 30 years.

So, who would benefit from the different structures?

Sale and lease back transactions have a long history dating back to the 1920’s when a number of UK retailers started to sell and leaseback their existing property to raise capital to invest in expansion.

The trend continued and in the 1980’s many high street retailers were making widespread use of this type of structure to unlock the value of their large property portfolios. Sale and leasebacks are therefore suitable for owners of property that are looking to raise capital from existing assets as it monetises previously sunk capital costs, there is also the potential to reduce the costs of occupancy of assets through setting appropriate rent levels at the outset of the leaseback.

In contrast to the sale and leaseback transaction, where ownership is permanently transferred to the investor, income strip’s give an option to the tenant to buy the asset back at the end of the lease. The investor owns the freehold throughout the duration of the lease term but providing the tenant does not default on any repayment the asset can be bought back.

As already mentioned, these transactions are often used to fund student accommodation and are also suitable for government and indeed local government organisations who may be looking for funding, are able to utilise existing property assets to unlock value but most importantly wish to retain a degree of certainty over the future ownership of the asset, i.e. not sell the family silver.

Why are investors keen to fund these transactions with local authorities?

At its simplest, an income strip transaction combines a strong tenant covenant, with a long-term lease and a forward funding arrangement to give an investor a stable and secure income stream.

The strong tenant covenant can come from the public sector, and the long-term lease often runs between 30 and 50 years. The stability and security for the landlord comes from an annual rent review linked to inflation rather than an open market rent.

This annual increase is often subject to a maximum increase, a cap, to protect the tenant from higher than expected inflation, and a minimum increase, a collar, to protect the landlord from price deflation.

With large amounts of institutional investment balances looking for attractive yields in this low interest rate environment demand is growing especially from pension funds for secure, long dated, index linked cashflows that can help hedge the long-term liabilities of pension funds.

So are they suitable for local authorities?

One of the main reasons for looking at income strips as an option for alternative sources of funding is that the profile of the lease payments can match the income generated from the underlying asset. Fixed rate funding may look cheaper, but the local authority may be exposed to unaffordable capital schemes if income levels fall below the cost of funding in the future.

An added advantage to this type of transaction is that the local authority retains the ability to generate income from the asset and at the end of the lease period the asset reverts to the ownership of the Council.

Examples of where we have seen this type of transaction used include car parks and office accommodation where the local authorities concerned were able to release capital receipts whilst retaining the income from the underlying business operation. With the ability to vary the annual income by inflation it is possible to ensure that you are protected against increases in the annual lease payments as well as the potential to generate a profit rent. Debt for yield projects may therefore be suitable for this type of funding in the future.

As expected, there are risk associated with any funding options and the risks that any council entering a transaction like this would need to consider would include:

- Income Risk – ability to generate sufficient income to meet rental payments

- Inflation Risk – ability to pass on inflation linked price increases to customers

- Operating Risks – costs associated with running asset may be greater than expected

However, these risks would also exist in other forms of capital investment and funding from traditional sources such as the PWLB and would also need to be considered in accordance with the requirements of the Prudential Code.

If you are thinking about alternative funding sources and think that this may be of interest to you then please get in contact by emailing mswallow@arlingclose.com.

We have a detailed understanding of all options available to local authority clients and can give an unbiased view on what is the right funding option for your circumstances.

Related Pages

Commercial Paper: Short term funding for the long term?

The UK Infrastructure Bank