iDealTrade is the UK’s only online, automated, matching platform for local authority loans. With working from home still dominating peoples work schedules and others slowly returning to the office, iDealTrade offers a solution to the current work schedule crisis and is easy to access (via a web browser) as well as being easy to use. The platform has over 485 registered users representing 200 local authorities and pension funds indicating there is a wide variety of local authorities with which to transact.

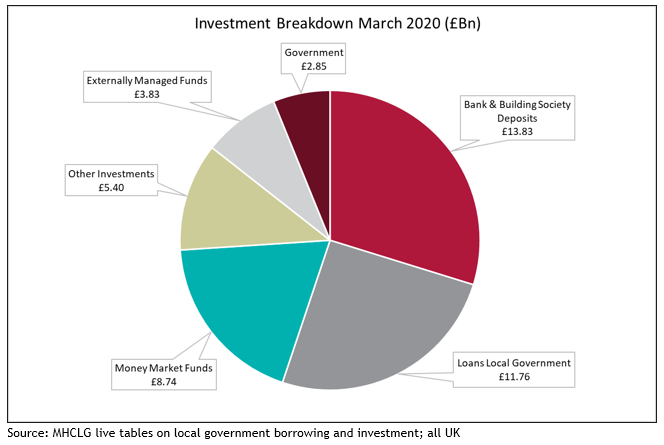

Why was the platform developed? iDealTrade was developed following local authority queries to Arlingclose regarding the financial strength of their peers. With the local-to-local market (excluding pension funds) currently standing at just under £12 billion as of 31st March 2020 (out of a total investment universe of c.£46bn), the market represents a large portion of credit exposure to many authorities. This is shown clearly in the graph below.

One of the ways that Arlingclose developed to help answer the aforementioned queries was to create a unique set of financial strength scores (FSSs). These FSSs have the objective of identifying local authorities who may be relatively weaker compared to other local authorities due to greater financial difficulties. They also aim to then allow these issues to be managed either through rate offered/duration/amount lent.

This approach is fully consistent with best practice in investment management as expressed in CIPFA’s Treasury Management Code of Practice, particularly the requirement to hold “well documented records of the standing of counterparties it does or may deal with, and continuous access to independent sources of advice and information on the same”.

It must be noted that the financial strength scores are not expected to prohibit an authority’s ability to borrow in the money market. The underlying credit quality of most authorities, regardless of rating, is expected to be strong. The ratings are not expected to be the complete guide to financial strength either, rather an indication of underlying risk, based on publicly available information, that highlights where further due diligence might be appropriate.

The Financial Strength Scores are made up of five categories to give an overall score:

- Level of indebtedness

- Interest cost burden

- Income flexibility,

- The level and rate of use of revenue reserves, and

- Budgetary control

Each category rating is the average of between 3-5 individual indicators, for a total of 20 indicators overall. One example of an indicator would be the ratio of debt to CFR, with individual authority ratings based on how close they are to the median authority in the dataset. For each indicator, 68% of authorities (one standard deviation in each direction) are awarded a “silver” rating, with the outliers rated “gold” (16% of authorities) and “bronze” (16% of authorities). This is representative of a normal distribution. The category scores are as follows (with the median authority receiving 0): -3.0 to -1.0 is Bronze, -0.9 to 0.9 is Silver and 1.0 to 3.0 is Gold. Scores are taken into the average at a maximum value of 3.0 and a minimum of -3.0, so that wide outliers do not overly skew the average. The data itself is sourced from publicly available data, mainly local authorities’ data returns to MHCLG. The FSSs are updated quarterly.

The gold, silver, bronze colour scheme represents the view that ‘everyone is a winner’ (other clichés are available) and that even relatively weak local authorities are still of a strong creditworthiness when compared to most commercial organisations.

With FSSs being one of the main draws of iDT, what else can the platform offer? For starters there are numerous benefits to the platform including: standardised loan documentation, partial order fill functionality, ability to deal for one or more authorities, a forward dealing function and a unique counterparty filter to name just a few!

Whether you are working in the office or from your kitchen table the platform can be accessed from anywhere as long as you have an internet connection and access to a web browser. So why not sign up or log in today to see what is available on the platform. You never know, you may just find your iDealTrade today.

If you are a local authority and are interested in signing up to the platform please email support@idealtrade.net.