Forward curves are not a substitute for a good forecast. A forward curve is a function of market participants trading based on their expectations of the future interest rate. Therefore, it would be used as part of the rate calculation if a Local Authority were to forward deal for either an investment or borrowing. But that does not mean it can be used to predict the future bank rate.

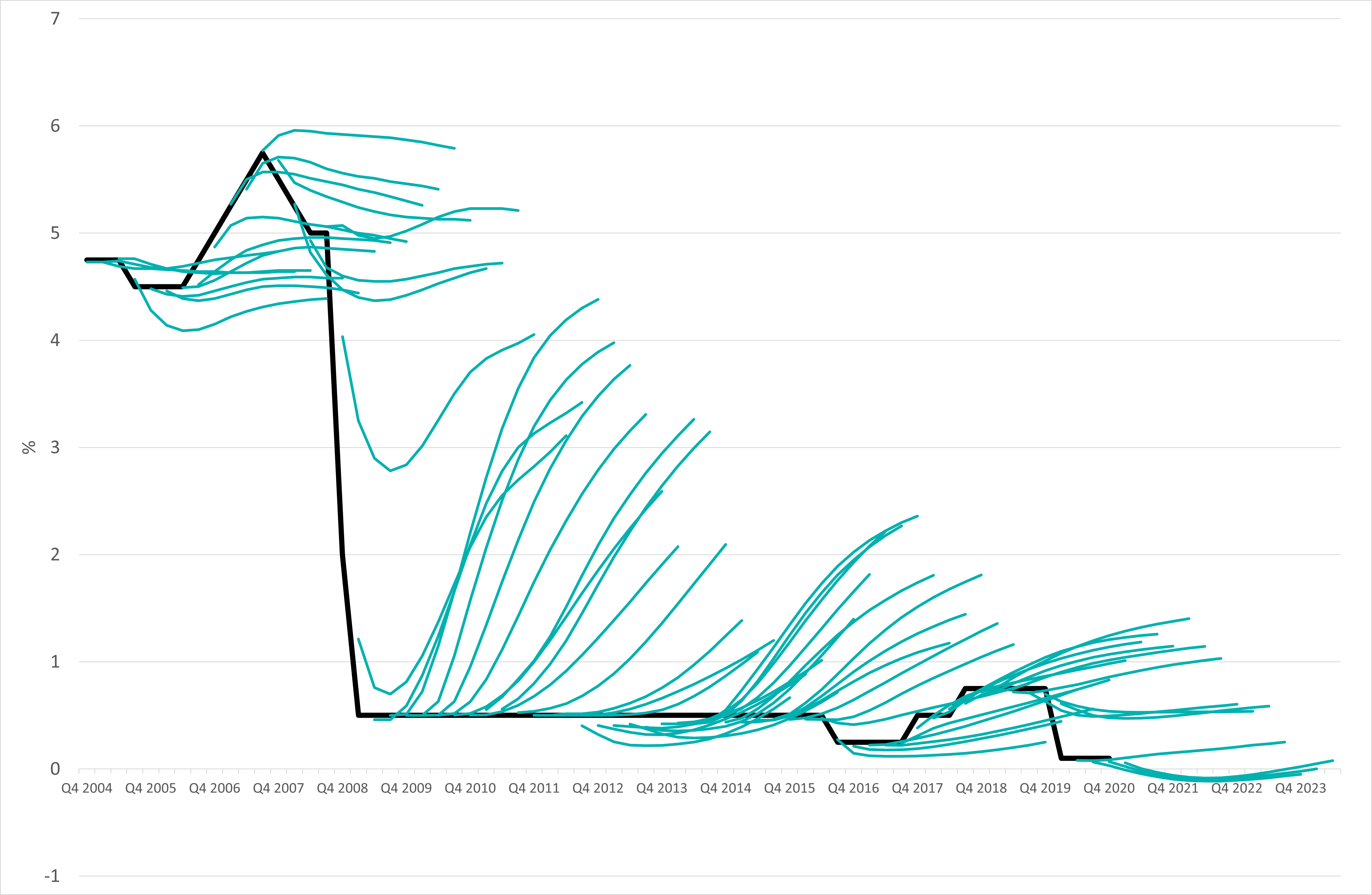

There are numerous rebuttals to using forward curves as forecasts. If the forward rate predicts the future spot rate, it ignores the durational risk. The theory also suggests that market participants are unbiased. Forward curves are often ambitious and reflect institutional bias due to what rate institutions want or need and based on their future cashflows that don’t necessarily match their current expectations. As a result, past forward curves have rarely reflected actual bank rate over the past 20 years (see chart).

Institutional bias has manifested in many ways; over-optimistic recovery after the Great Financial Crisis, pessimism during the Eurozone debt crisis, pre-Brexit optimism and the COVID slump. What do these all have in common? A Black Swan event. These ambitious forward curves rely on a steady state outlook, if all things remain equal the recovery would materialise as planned. And of course, it could be argued that institutional bias only applies to a single organisations’ forward curve, but herd mentality positively or negatively reinforcing market opinions suggest the entire market can be wrong. The forward curve falls down as a forecasting tool because it is prone to overreaction – the herd mentality overstating both upward and downward movements.

As can be seen in the chart, the lower for longer trend is gradually being built into market expectations, however, has taken the better part of a decade to taper expectations. The tapering of expectations can often be reflected in a good forecast.

A good forecaster often uses actual data and leading indicators to guide their expectations in a more tailored way rather than relying purely on market sentiment. The inputs into the Arlingclose interest rate forecast takes a holistic look at the economy, the economic factors influencing decisions, but also the non-economic factors and the views and influence of decision makers in a measured way. This includes usual metrics like data on inflation, labour market, earnings, GDP, but also an in depth look at exchange rates, PMIs, consumer credit, savings ratios, sentiment and more.

A good forecast can justify and facilitate better treasury management decisions. The decision between borrowing now and incurring a cost of carry, as opposed to borrowing later, or investment now versus using internal borrowing can potentially save Councils millions of pounds (subject to scale of borrowing/investment). The forecast should form part of a Councils strategy when it comes to implementing projects and policy decisions.

If you would like to discuss the Arlingclose interest rate forecast, please do get in contact sjones@arlingclose.com