While the banking sector stresses which started with the collapse of Silicon Valley Bank earlier this year mostly appear to have dissipated, some concerns have lingered and risk measures such as CDS prices remain at modestly elevated levels. Our clients will be aware that because of this, for the time being at least, we continue to take a conservative stance on unsecured bank lending.

In an earlier Insight, the methodology used by the Bank of England’s Financial Policy Committee (FPC) to stress test UK banks as part of its annual cyclical scenario (ACS) was discussed. The results of the latest stress tests have now been published and are summarised below. Spoiler alert, it’s good news. The latest results show that major UK banks would be resilient in the face of the FPC’s severe stress scenario, a positive reflection of the strength these institutions have built up in recent years.

As a reminder, in the stress scenario, weaker household real income growth, lower confidence and tighter financial conditions cause more severe domestic and global recessions. The assumptions include UK Bank Rate rising rapidly to 6% in 2023, UK GDP contracting by 5%, world GDP falling 2.5%, UK unemployment rising to 8.5%, UK house prices falling 31%, and UK commercial property and equities both falling by 45%.

Moreover, the macroeconomic scenario includes UK consumer price inflation averaging around 11% for the first three years of the period, peaking at over 17% in early 2023, and only falling back gradually to hit 3.4% by end 2024 and 2% by 2027.

Although the stress test scenario was not intended to be a forecast of macroeconomic and financial conditions and is considerably more severe than the current macroeconomic outlook, the current environment is closer in some aspects to the scenario than it was when it was devised.

In terms of some differences between the latest and previous ACS tests, compared to the previous test in 2019 in 2022/23 the banks started with higher deposit balances as well as better asset quality, all of which helps to dampen the negative effect of the shocks in the test scenario.

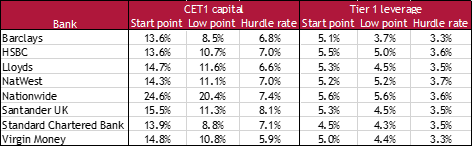

The results indicate that under the test scenario, in aggregate and individually, all banks and building societies included remain above their Common Equity Tier 1 (CET1) and Tier 1 leverage ratio hurdle rates. The main driver of downward pressure on the capital ratios is identified as coming from credit impairments whereby banks incur impairment charges of £125 billion over five years.

Looking at the banks’ aggregate position, under the test scenario the aggregate CET1 ratio falls from 14.2% to a low of 10.8% compared to a hurdle rate of 6.9%. While the aggregate leverage ratio falls from 5.3% to 4.7% against a hurdle rate of 3.5%.

At the individual bank level, based on the low point of the ratios (with the bank having taken the required mitigating actions), the results show that no institution is required to strengthen its capital position, indicating that major UK banks can withstand the severe macroeconomic stress while still being able to support businesses and households. The individual results are shown in the table below.

For the first time the test included an assessment of the ringfenced subgroups (Barclays Bank UK, HSBC UK Bank, Lloyds Bank and NatWest Holdings). Again, the results are positive, indicating that all ringfenced banks remain resilient in the face of the scenario and with no specific vulnerabilities identified.

So, overall, it’s good news for the banks being tested and positive for the banking sector in general. While the results should help to allay fears about the resilience of banks in the current economic and financial climate, making unsecured investments with banks still means the risk of a bail-in. However, this risk can be mitigated, and anyone interested in finding out how we might be able to help them with this should please get in contact.

Lastly, for anyone wishing to read the source material, the Bank of England’s report can be found using the link below.

https://www.bankofengland.co.uk/stress-testing/2023/bank-of-england-stress-testing-results

Related Insights