So, we’re here. After nearly two years of upward moves in bond yields and wild levels of volatility, we have attained the calm sunlit uplands of peak rates. Investors can bask in the knowledge that policy rates will not be moving higher – the next move will be down, whenever that may be. Volatility is a thing of the past. Take a breath…

You can therefore imagine how surprising it is to see 10yr gilt yields up 20 basis points in one day yesterday (yields eased a little into the close). In fact, since the MPC decided to hold Bank Rate at 5.25% last Thursday, the 10yr yield has risen 25 basis points to 4.50%. So, what is the market communicating here? Is it that interest rates need to move higher to calm inflation, or does it indicate a collective belief that rates will remain higher for longer? A bit of both?

It is certainly the case that central banks have picked an interesting time to imply an end to interest rate hike cycles (not the monetary tightening cycle, this will continue with QT). I say simply because no central bank has actually said that rates will not rise further (for reasons covered later), in fact the Federal Reserve communicated a further rate rise in its dot plot. However, the official communications from the recent Bank of England, ECB and FOMC meetings certainly implied a lengthy pause.

Anyway, an interesting time. Oil prices have been inexorably and rapidly moving higher due to supply restrictions imposed by members of OPEC+, at a time when US reserves are running critically low. Wholesale gas prices have also been moving higher ahead of winter demand. Oil and fuel prices will now have a lower disinflationary impact and in some case even an inflationary impact on headline inflation rates going forward, providing an offsetting influence on the wider downward price pressures seen in other areas. This will slow the decline in inflation back to policy targets.

Meanwhile, policymakers purposefully maintain their hawkish stance to ensure that financial conditions do not ease. This can be seen in the FOMC dot plot, suggesting a further interest rate hike in the coming months, but also in the slew of policymaker speeches. The more hawkish promote the need for further rate hikes, while the more dovish seek to prolong the duration of current levels. The drum has been beaten constantly, reinforcing the hawkish message from the last FOMC meeting.

The other on-going factor is the resilience of the US economy. While data has been mixed, certain releases provide ammunition to support the no recession argument. The durable goods orders data recently beat forecasts, and we don’t need to say anything about the general theme of better-than-expected figures for the US labour market. The market is anticipating stellar Q3 GDP figures, with the Atlanta Fed GDP nowcast at 4.9%. What recession indeed.

Let’s throw in the potential US government shutdown too!

Ultimately these factors have been digested by investors and have had some effect on expectations of peak rates and potential policy loosening. There has definitely been an upward move in short term rate expectations. Last week UK SONIA pricing suggested a 60% chance of a further rate hike to 5.50% in early 2024; by 28th September this had exceeded 100%.

So, it is wholly interest rate expectations? It’s certainly true that inflation expectations have not changed much; the UK 10yr breakeven rate is only a couple of basis points higher than the post-September MPC close. This would imply that long-term real interest rate expectations have driven the majority of the upward movement. To put it another way, the market is suggesting that real rates need to be higher in the future to maintain inflation at current projected levels. This again feeds back into the oil price/resilient growth story.

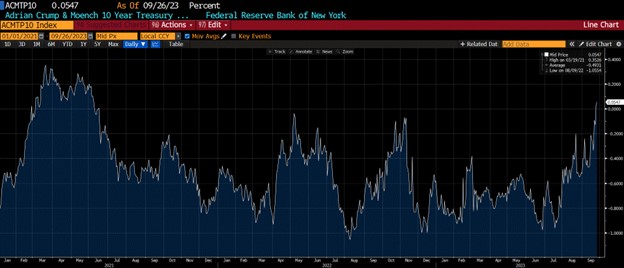

However, what we do know is that uncertainty feeds into higher yields; it seems that investors are seeking to be compensated for holding long-term fixed rate bonds amid the heightened risk of volatility in short-term rates. Below is a Bloomberg chart showing an estimate of the term premia, which is a calculation of what yields should be, given shorter-term rate expectations against what they actually are, on the 10yr US Treasury bond. It has risen back into positive territory for the first time since 2021 and can explain most if not all of the recent rise in long-term bond yields.

Source: Bloomberg

So, what to make of this? Are long-term bond holders simply buying into US and global policy expectations? It’s a possibility and may have played a role, but the move has happened extremely rapidly following a general consensus on rate expectations. Higher short-term rates will inevitably increase the economic pain and require looser monetary policy in the future. This is not explained by the recent parallel shifts across the length of government bond curves.

Investor uncertainty appears to be a significant driver. The uncertainty generated by rising oil prices, fiscal policy, mixed economic data and policymakers themselves, has helped to achieve policymakers’ aims in maintain tight/tightening financial conditions, which will ultimately bear down on economic activity and inflation.

As with past rises in term premia, it could be a temporary phenomenon, although this has multiple outcomes; a decrease in uncertainty because interest rate expectations rise (yields stay higher) or a decrease in uncertainty because interest rate expectations remain stable (yields fall). Given my expectations for weak multi-year growth across developed economies, I naturally fall into the latter camp.

Related Insights

An Updated History of Base Rate