In April 2020 Arlingcose worked with one of its local authority clients to transact an Interest Rate Swap (Swap) which locked in a rate of 0.56% on £75million of funding for a period of 20 years. This was the first transaction of its kind to have been undertaken by a UK local authority since the 1990’s.

So what is a Swap?

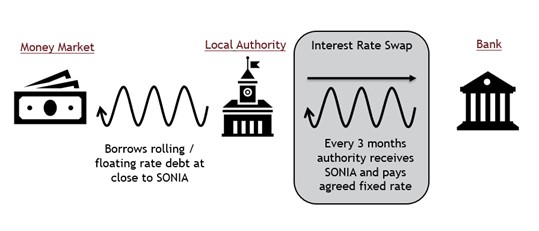

A swap is a mechanism which converts a floating interest rate to a fixed rate, giving certainty over the interest rate payable, as opposed to the variability associated with a floating rate. It is a stand-alone financial instrument, the terms of which are agreed independently to the underlying short-term debt.

Why did the Council look at a Swap?

In October 2019, the Council in question had an exposure of £377m to short-term debt out of a total portfolio of £503million, 71% of its debt was therefore at risk to interest rate movements.

Short-term rates were on average 0.86% whilst the 20 year PWLB rate was 2.97%. The Council wished to reduce its exposure to interest rate risk but the differential between short-term and long-term rates was unaffordable. An interest rate swap provided the opportunity to manage this risk and lock in funding at a low rate and remove any risk of rising interest costs.

What were the Details of the Swap?

In April 2020, a swap was transacted that secured the interest rate on £75million of the Council’s short-term debt at a rate of 0.56% for 20 years, the PWLB rate was 2.62% on the date of the transaction.

As well as reducing risk the transaction saved the Council around £1.42million a year over 20 years (£28.5m in total) when compared against the alternative of fixing with the PWLB.

Controversy over the use of Swaps

The House of Lords ruled in 1992 that neither the 1972 nor 1989 Local Government Acts provided a legal power for local authorities to use financial derivatives including interest rate swaps.

Their use by many local authorities, notably Hammersmith and Fulham, was therefore ultra vires. Subsequent rulings prevented the counterparty banks from recovering their economic losses.

Since the 1990’s local authorities have been given various powers most notably the General power of competence in the Localism Act 2011 which gives councils the power to do anything that individuals generally may do, with few limitations.

Our client obtained a QC’s opinion confirming that these latest powers extended to the power to enter into interest rate swaps for risk management purposes.

Members of CIPFA’s staff stated at the time the transaction took place that the Swap was “illegal” despite the points raised above but to date there has been no legal challenge made over the April 2020 transaction.

The following documents published by CIPFA contain guidance on the use of derivatives by local authorities:

- Treasury Management Code Guidance Notes for Local Authorities

- Practical Guidance on the use of Financial Instruments to Manage Risk

- Prudential Code for Capital Finance in Local Authorities

- Code of Practice on Local Authority Accounting

The CIPFA Treasury Management Guidance Notes contain the following detailed guidance on their use:

“It is essential that where authorities are considering the use of financial instruments to manage treasury management risks, they should always:

- ensure that they have the legal power to enter into such transactions

- define clearly their approach to risk management and the use of such tools in their treasury management strategy

- clearly state the instruments that they propose to use and in what circumstances

- use such financial instruments for the prudent management of their financial affairs and never for speculative purposes

- seek proper advice and consider that advice when entering into arrangements to use such products to ensure that they fully understand those products

- satisfy themselves that they understand fully how underlying risks are affected and any additional risks that may result”

In addition, TMP1 Risk Management details that an organisation “will manage its exposure to fluctuations in interest rates with a view to containing its net interest costs” through the use of “approved instruments, methods and techniques, primarily to create stability and certainty of costs and revenues, but at the same time retaining a sufficient degree of flexibility to take advantage of unexpected, potentially advantageous changes in the level or structure of interest rates”. It goes on to detail that “any hedging tools such as derivatives are only used for the management of risk and the prudent management of financial affairs and that the policy for the use of derivatives is clearly detailed in the annual strategy”.

Despite some strong views on this particular transaction, CIPFA themselves have not issued any formal views on this area of prudent risk management and the Treasury Management Panel have been silent on the issue.

Is the Transaction still good value?

From the Councils perspective the transaction was about providing certainty on a proportion of its funding which was subject to interest rate volatility. Since the transaction was undertaken interest rates have been volatile and the effective fixed rate of 0.56% can be compared against the PWLB rates available at the date of the transaction and each anniversary since.

At no point during the last three years has the Council been able to obtain funding anywhere near the 0.56% fixed rate achieved through the Swap. Rates on 6th April 2023 for the remaining life of the Swap are 8 times higher, if the Council did not have the Swap in place but instead fixed out a 17 year loan this would result in additional interest costs of £15.4million.

In addition to this the mark-to-market value of the Swap has increased giving the Council an asset currently worth £31.7million which confirms the value of the Swap transaction. The bank on the other side of the Swap transaction have been required to post collateral with the Council to provide protection in case of a banking default, these cash amounts have either been invested generating an additional return or used as internal borrowing at rates linked to SONIA so again great value to the Council concerned.

Hindsight is a wonderful thing, but the Swap transaction undertaken in April 2020 has provided certainty of cost of funding for 20 years at an interest rate that will probably never be available again in the local authority market. More local authorities should have transacted Swaps over the last three years as savings against the prevailing PWLB rates would have been achieved and certainty of funding costs would have been achieved.

How can Arlingclose help?

As mentioned at the outset of this insight we worked closely with our client in the execution of the Swap transaction and are therefore experienced in working with local authorities in using this type of instrument to manage interest rate risks. Areas where we would provide particular support include, but are not limited to:

- Assessing what amount should the Swap apply, ensuring that the local authority does not become ‘over hedged’ should future levels of debt fall below the swap notional.

- Calculating an appropriate Swap rate which is linked to the current short-term funding rate

- Credit and counterparty risks, finding a bank that is willing to trade with a local authority whilst ensuring that the local authority is protected against and potential future credit event.

- Assisting with the accounting treatment for the Swap.

As always if you wish to discuss any issues surrounding your debt management strategies or borrowing options, please get in touch with your client relationship manager.

Related Insights

PWLB Reduced HRA Lending Margin

Arlingclose advises on LOBO refinancing for Braintree District Council