Investment portfolios are like onions. How? They both have layers! As you can probably tell, I am no comedian, and this is not a joke. Fortunately, I am a Treasury Management Advisor and layering your investments can maximise your income.

A local authority has various incomes and outgoings at different points in time, hence the need for treasury management. However, over the longer term, this means there are a variety of scenarios and options for investment, each with their own merits. Two of these scenarios have been shown below. For the sake of argument, scenario one has been invested in entirely liquid balances. This can be a mix of bank call accounts, money market funds and CDs. The opening balance of this investment portfolio is high at the start of the financial year due to various government grants and income that are held for the purposes of spending throughout the year. What has also been factored in is spending through the year, and some (hypothetical) semi-annual, quarterly, and monthly income.

Depending on the size of the portfolio, it may be entirely appropriate to hold all investments as instant access. However, where capacity allows, it can be a significant benefit to the Council to invest longer term and in a wider variety of investment instruments. Many Councils already do this, however there are several options available to further increase a Councils investment return. Simply by creating layers of a Councils investment portfolio in an optimal way based on their spending needs; an increase in investment income can make a material difference to revenue.

If there is a natural minimum balance that the Council is forecast to not go below, in this worked example £10m (a handy amount given the MiFID required level for professional status clients), this would seem an appropriate allocation to invest longer term; this is the base layer. However, the layers on top of this can also benefit diversification and investment return. A near-cash buffer such as cash-plus funds (in this example £2m allocation yielding 0.5%) can pick up additional returns versus money market funds, whilst still providing a degree of liquidity should the Council’s cash flow forecast not come to fruition as expected. Furthermore, a liquid balance on top of this can be invested in a targeted manner. This suggests that, if there is capacity for a 3-month deposit for a £5m allocation before it must be spent, the Council can maximise return by investing in some non-liquid short-term instruments.

Whilst maintaining a certain level of liquid balances, the Council can overlay this with a variety of facilities that can provide a “top-up” to the income they are already receiving (for more information on revolving credit facilities and working capital facilities, please contact Stuart Jones via sjones@arlingclose.com). In this worked example, a Revolving Credit Facility has been provided to a hypothetical Housing Association with a non-utilisation fee attached (£2m allocation and the non-utilisation fee of 0.4%). The Council can set money aside in a money market fund, in the knowledge that if it is not used by the HA, they are receiving extra income, simply because they are providing the facility. If the facility is used, the Council also receive a pick-up in rate.

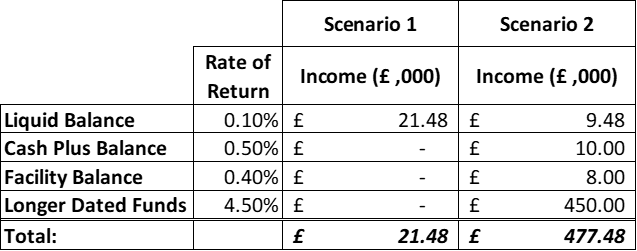

To put these two scenarios into numbers, the investment returns have been outlined below:

Want to know more? Please contact the Arlingclose team for information on strategic fund allocation and for information on RCFs and diversifying your liquid balances.