Investors of all stripes have had a pretty challenging time over the last two or three years. A global pandemic, war in Europe, a sea-change in central bank monetary policy, a likely reversal in some of the decades-long shift towards greater globalisation as well as the re-emergence of geopolitical tensions old and new, all of which have meant a bumpy ride in financial markets.

Far from a new debate, but under challenging market conditions, actively managed investments were traditionally considered to potentially offer an edge compared to passive investing, with the active manager using their expertise to identify opportunities that passive investments could do little about. Given the challenge presented by the last few years, are we any closer to settling the perennial active versus passive debate?

Some recent research from AJ Bell found that just 27% of active equity managers beat a passive alternative in the first 11 months of 2022. Moreover, Morningstar research found that in 2022 indexed vehicles saw inflows of almost $750 billion globally, while their active counterparties had outflows close to $1.3 trillion.

So, should all investors switch to passive? Well, investing isn’t a binary choice between active or passive, growth or value, large cap or small cap. It’s obviously a lot more complex (otherwise these discussions wouldn’t still be going!) and what suits one investor doesn’t suit another, or what suits one investor at a point in time may not suit them a moment later.

As regular readers will know, most of our clients’ long-term investments are primarily focused on the generation of income, with secondary aim of growing the capital value over time.

In the passive investing space, index trackers filter a broad universe of companies into a smaller subset in accordance with a particular strategy or set of rules, including for income-focused investments filters for high dividend yields.

Back in late 2021, an Insight by yours truly looked at the performance of a basket of four such passive investments covering global and UK equities. The analysis showed that over the 12 months to 31st October 2021 the income returns ranged from 3-7%, while on over five years the annualised income returns ranged from a very respectable 3.5-5% with levels of volatility in line with what had been in the actively managed equity fund space.

Well, a fair bit has happened since then, so how have they performed more recently?

Over the 12 months to end May 2023, these four investments generated income returns of between 5.0-5.5%. When looking at longer time horizons, similar levels of annualised income returns were generated over three years (5.5-6.0%), while over five years it was lower, but still a very respectable 4.0-4.5%.

So how do these figures compare to the actively managed funds our clients use?

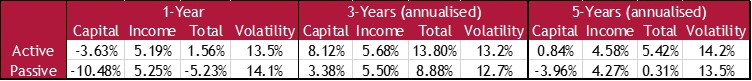

Although not precisely the same time horizon, over the 12 months to end March 2023, these active funds generated an average income return of 5.2%. Over three years the average annualised income return was 5.7% and over five years 4.6%, so very similar to our passive comparators (albeit the active funds have a wider dispersion of returns). In terms of the volatility of the total returns, they were also very similar across both types of funds.

A performance comparison table showing average returns and volatility for each group of funds analysed (four passive, seven active) is below.

So, what can we take from this? Well, based on our admittedly very small sample, we’re no closer (completely expectedly) to settling the active versus passive debate, and perhaps we may never will be. Some active investments will outperform their passive equivalents, and some will underperform, none of which is especially helpful to investors.

However, investors are generally free to move their capital as they see fit, seeking the opportunities that best meet their objectives at the time. Sometimes those choices may prove more profitable than others with the benefit of hindsight, but in the absence of complete certainty over the future (until such time as our AI robot overlords can provide this), maybe there should always be debate around such things and key to this is that there is always a wide variety of options available to investors.

Related Insights